Will mortgage rates go down in 2022? Get Brian Icenhower’s take on what happens to home prices and the real estate market in general.

Will mortgage rates go down this year? Today I’m going to dive into some market predictions for the remainder of 2022. And, I’ll share with you some data to back up what I’m saying. Plus, get a free download of our “Rising Rates = Rising Home Prices” infographic.

VIDEO: Will Mortgage Rates Go Down in 2022? Get Brian Icenhower’s Take

Increasing mortgage rates do not create a decrease in buyer demand – quite the opposite.

If we look at historical data, when rates went up, prices went up with them.

The real estate industry, and the public at large, are freaking out. Mortgage rates are going up! What is this going to do to the housing market? Will mortgage rates go down? I want to address this for a few reasons. It is an important concern to consider as we communicate with our clients. It also affects how we adjust our own mindsets.

Understand that I look to historical data when making my market predictions. This is not speculation. We have the ability to look at historical trends and learn about the effect that interest rates have on home prices.

A few things always happen when rates go up

- Lull in listings. All of a sudden there’s a lull. People pause like a deer in the headlights and try to figure out “what’s going on.” New listings don’t enter the market at the same frequency. Why? Potential sellers don’t want to lose their “low” interest rate. They adopt the mindset of, “Well, let’s just wait and see.” These lulls happen, but they are temporary.

- House prices still go up. When there is even lower inventory (because of held-back listings), prices rise. In fact, housing prices go up faster as interest rates rise. Supply is reduced because fewer people are listing their properties while demand remains the same.

- Urgency increases. Rising rates will do nothing but exacerbate increased home values. This, ultimately, increases urgency for people (who want to either buy or sell) to make their move. That’s why the lull is temporary.

Will mortgage rates go down? Mortgage rates are not determined by the government

Rates oftentimes follow the federal funds rate. When the federal reserve chairman sets new interest rates, it’s not the mortgage rate. It’s the federal funds rate – that’s the rate that banks use when lending to one another. The mortgage rate is actually tied to an open market algorithm, which in turn is closely tied to ten year Treasury Bill sales. This is where people invest when they want to invest safely. When people sense market volatility, they opt for the safe investment option.

This is why mortgage rates tend to follow the federal funds rate. When the economy gets going at a rate that appears too crazy and too “good,” the feds respond by raising the interest rate. The intention here is to slow down inflation so that it doesn’t get out of control. The mortgage rate typically follows their lead, but not always.

Will mortgage rates go down while the federal funds rate goes up? There have been many times in history where mortgage rates chart their own course. The federal government has learned how to manipulate the mortgage rate.

Will mortgage rates go down if the government manipulates the system?

In short: yes, they may. If we look to history, we can see how we needed it after the big recession in 2008. They called it “quantitative easing”. The government wanted to “quantitatively ease” our way out of this recession. So even though the federal funds rate was low, the government decided to manually buy back mortgage-backed securities to help “buy down” the mortgage rate.

It doesn’t even matter on which side of the political spectrum the government leans at the time. As much as certain parties like to say they want to “cut spending,” not one president has actually delivered.

Why? There’s always a good excuse. No one wants to be the president that cuts spending and raises mortgage rates and hurts the economy. So they all keep doing it. I’m not sure they’ll ever stop. It could be a war, a recession, a pandemic … you name it. There’s always some reason that we need to continue to “help” the economy for the good of American citizens. Our future generations will likely pay the price, but this is the way it has been for decades.

Will mortgage rates go down? It’s possible.

It will be interesting to see if rates go up. There’s a good chance they won’t. Part of me predicts that mortgage rates will go down if we let the natural open market dictate the rise. Then we can be more “honest” about what is really going on and get more in line with reality. Back when the 2008 recession hit, we learned that this wasn’t always necessary. We learned how to manipulate things.

We’ve been saying “rates are going to go up!” for over 20 years now. They still haven’t. We’ll see. I wouldn’t say it will happen for sure.

Will mortgage rates go down? It could happen. It’s definitely not impossible. If the government decides to “correct” things again, like they did in 2008, it would not surprise me.

Two ways the rising mortgage rates could hurt us

- It can hurt housing prices. As prices go up, this affects buyers and sellers. It can ultimately affect agents as buyers decide to “wait” and sales volume may temporarily decrease.

- Increased mortgage rates could cause sales volume to decrease. This is concerning. Fewer listings means lower sales volume for real estate agents. That being said, it will be a temporary slowdown – a lull. We are reading reports that sales volume went down year over year. As of February 2022, it went down 5%. To put those figures in perspective: that makes it the second highest volume year in the history of America. So yes, things are slowing. But it’s not an earth-shattering difference. Trust me, a pandemic didn’t slow us down. An overseas war isn’t slowing us down. The rising interest rates are not going to slow us down, either. Housing prices continue to rise. We will continue to make sales. People will always need a place to live.

Online leads are experiencing a lull

Agents who use online lead sources have probably noticed that those leads are slowing right now. All of your online lead sources, like Zillow or Realtor.com, aren’t giving you many leads right now. Well, that’s because we have a lull due to rising interest rates.

During a lull, people don’t list their properties for sale. Did you know 95% of all online leads come from listings? If there are fewer listings, you’re going to have less online leads. Everyone is experiencing this problem right now. It’s because we are in a lull, during a low inventory year, as we’re coming out of winter. It’s the perfect storm to create a low number of listings.

Don’t worry. Listings will come. Spring is here. Soon you’ll start to see more listings. At that time, we’ll change our conversation to time management because you’ll once again have more business than you can handle. These are the ebbs and flows of the real estate market.

When housing prices rise, and they will continue to rise, people gain equity in their homes. When people gain equity in their homes, they get more money. And, when people have more money, what do they do? They spend it! This is human nature. It’s time to trade up to a bigger house. Buy vacation homes. Purchase investment properties. We are in an open market economy. It’s a beautiful thing!

In real estate we call inflation “appreciation“. We like inflation. Will mortgage rates go down? It’s not likely, unless the government intervenes. And if they don’t intervene, we’ll see a rise in rates and a rise in home prices.

Proof behind my words

At ICC, we teach all our clients to, “show, don’t just tell.” When they ask you questions like, “Will mortgage rates go down?”, have data ready to back up your predictions. And, as you talk to your clients, who are likely freaking out based on some article they read online about the real estate market crashing or the “bursting” real estate bubble, show them the proof.

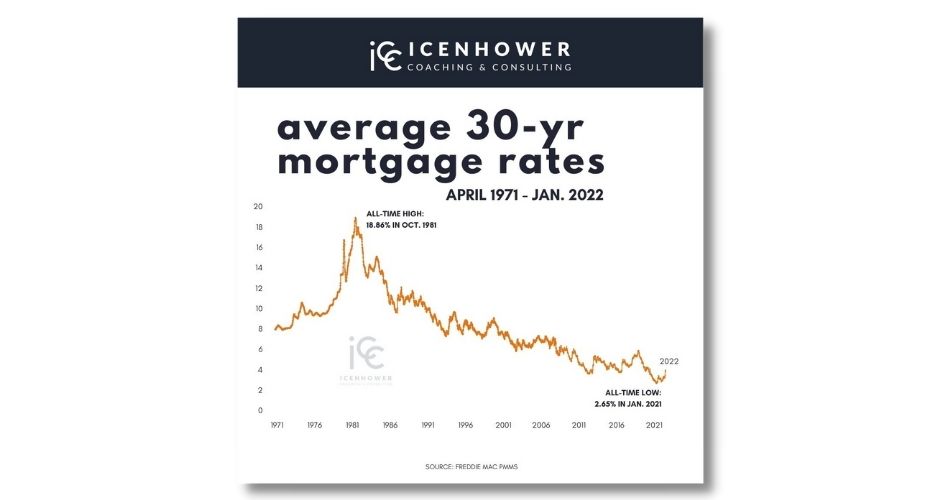

Average 30-Year Mortgage Rates

Check out this chart that shows the change in “Average 30-Year Mortgage Rates.” Relatively speaking, we’re looking pretty good. The 50-year average is around 8%. It’s entertaining to hear people say, “Oh man, rates are climbing up to 5%! What am I going to do?!” If you’re as old as me, you’re thinking, no big deal. I sold the most real estate of my life when interest rates were in the 8-9% range.

People will still buy and sell houses. Take a look at the 1980s. This was where we saw our all-time highs. It climbed to 18.8%. In the 80s, the average was around 13-14%. Keep this in mind! It was also a red-hot housing market in the 1980s. That was a time of excess.

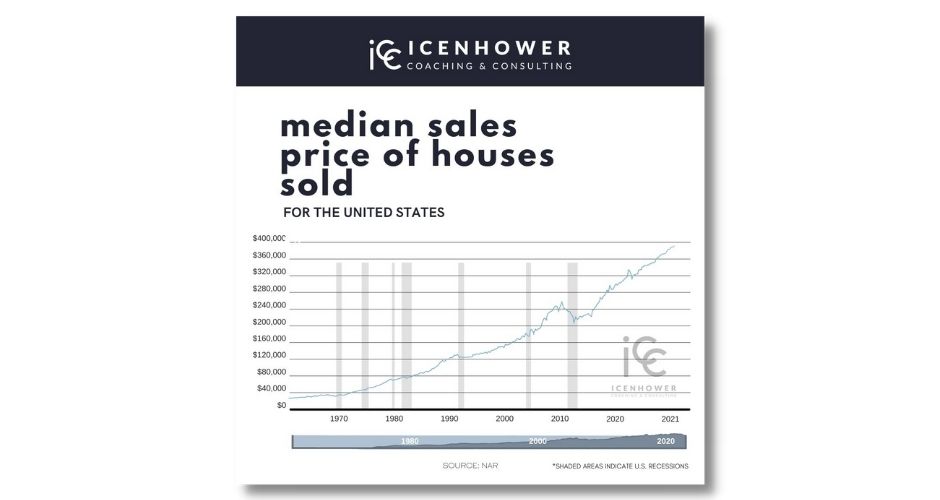

Median Sales Prices of Houses Sold

If you look at our infographic on “Median Sales Price of Houses Sold” you will see this. Prices continued to climb. Prices almost doubled during the 1980s, even while interest rates were high. Rates don’t stop people from buying and selling. In this chart you can also see where the Great Recession hit. Yes, there was a dip, but it corrected itself in a matter of years and continued to climb. If people stuck it out, they got their equity back, and then some.

Rising Rates = Rising Home Prices

In our chart “Rising Rates = Rising Home Prices” you can learn some really interesting data that proves my point. Increasing mortgage rates do not cause a decrease in buyer demand – quite the opposite. If you look at each of these different time periods, you’ll see that home prices have increased regardless of interest rate increases. In fact, you’ll see that during time periods where interest rates jumped the most, housing prices jumped even more significantly.

Get a FREE download of our Rising Rates infographic at the end of this blog.

Mindset check for your real estate clients

The best time to buy is now. You must remind your clients of this again and again. Urgency has never been higher. Rates are increasing and home prices are increasing. Will mortgage rates go down? Don’t count on it. Waiting has never been a worse idea, whether you are a buyer or a seller.

Mindset check for you as a real estate agent

This is the best time to be a real estate agent. Listings are coming; this is just a lull. And when they come, you’ll find yourself slammed again. Look to the data and the graphics we have provided to remind yourself of historical truths. The sky is not falling! Will mortgage rates go down? Don’t count on it. Supply is low, demand is high, interest rates will fluctuate, and prices will always go up.

FREE DOWNLOAD: Rising Rates = Rising Home Prices Infographic

Today we are giving you our Rising Rates = Rising Home Prices Infographic. Download and save. Share with your clients who want to “wait it out” for prices to drop.

Want to learn more?

- Read The High-Performing Real Estate Team. You can buy one of the best real estate team books on Amazon.

- Subscribe to The Real Estate Trainer Podcast. You can find it on Apple Podcasts, Google Podcasts, Spotify, Podbean, and anywhere you listen to your favorite podcasts.

- Join the Real Estate Agent Round Table. We are always posting fresh content, including market updates, free templates, and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a form to fill out to subscribe. You’ll be the first to find out about our new resources, free downloads, premium online courses, as well as promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.

Check out our latest posts:

- The Social Media vs AI Real Estate Marketing Battle – Which Will Win?

- Why Generic AI Prompts Are Killing Your Follow-Up — And How to Fix Them Using Perplexity AI

- How to Coach Real Estate Agents Using DISC Behavioral Assessments

- The Real Estate Agent Burnout Problem — And the Simple Habits That Fix It

- Are Real Estate Teams Dying Off? How the Strong Survive