Learn these 1031 exchange rules and scripts for real estate agents to properly advise and help clients sell properties and defer their federal capital gains taxes.

A new hot topic in real estate surrounds 1031 exchange rules. The reason it is suddenly a hot topic is largely because of the new political administration. We see new laws and rules fluctuate as we shift from republican-run administrations to democratic ones. In this blog and video below, I’m going to dive into this topic and explain what you can do to help advice your clients. And, how to use this as a case for client urgency!

VIDEO: 1031 Exchange Rules and Scripts for Realtors

What is a 1031 exchange?

A 1031 exchange enables someone to defer their capital gains off of an investment property, or a property used for business purposes. The 1031 exchange itself is a swap of one investment property for another. This does not apply to personal residences. You don’t pay capital gains on a personal residence that you live in for more than two years. But, if you rent it out, AirBnB it, or use it for business purposes, when you sell it, you pay capital gains tax.

This capital gains tax has been relatively low for several years. We had a republican administration, so that was typical. However, the current tax plan by the current democratic administration is going to shift away from this. Not only are they talking about increasing the capital gains tax rate, they’re talking about abolishing IRS 1031 exchanges. Do I think this will actually happen? No. But they are throwing it out there so they have some negotiating room with the republican decision makers.

Talk to your clients about 1031 exchange rules

It would behoove people who are looking to move up and exchange property to hurry up and do it this year while they still can. This might be the last year that you can defer your capital gains taxes. This will create a lot of urgency in your sellers! If you know people that own investment and business property and they want to trade up or trade to different types of property with this new found equity, now’s the time! See how this increases urgency?

This is why real estate agents are getting a lot of calls about 1031 exchange rules. People are panicked. They’ve got property, and they may have been waiting for the “top of the market” to sell, but now they are realizing that maybe they can’t wait. They don’t want to lose their ability to do the 1031 exchange at all.

Remember: you’re not an attorney

My first line of advice: you are real estate agents, not attorneys. Do not give too much advice about 1031 rules. Go to your escrow or title company and be in contact with the Accomodator that accomodates 1031 exchanges. These are the people that work alongside your escrow or title company (just like a lender does) to make sure all of the timelines and documentation requirements are satisfied. This is the person who is the best source of information for you. You can get set up a meeting with the Accomodator and your client to get a really clear understanding. And, you will add value to your client by setting this up!

Get an expert involved. It is much better than you running the risk of spouting out tax and legal advice when you don’t have a license to do either of those things. Here’s a script to use while explaining this to your clients.

Hey CLIENT, I’m excited to help you with this. However, I’m a real estate agent. I’m not an attorney or an accountant. That said, I can help you understand your options and put you in touch with an Accomodator that will be able to answer all of your questions and help guide you to the right solution for you. Together, we can work with the Accomodator and get you taken care of.

My personal advice

With all that being said, I do know a thing or two about accounting, I am a licensed attorney, and I’ve done a lot of 1031s. I’m going to do my best to explain these 1031 rules to you. And, I’m going to pass on the knowledge that you can pass on to your clients. Remember, I’m not your attorney, you have not paid me any money, so I recommend you get your own Accomodator before you act on this advice.

So, my advice when it comes to 1031 rules … You can defer your taxes. It’s a great thing to be able to do. In the future, you’ll probably have to sell, and if you want the money, you’re going to have to pay these taxes. If you die, as it currently sits right now with the tax code, your tax basis steps up, and your kids (or whoever your heirs are) will not pay the capital gains.

If you pay for a property at $50,000 and it goes up to $200,000, you have a gain of $150,000. And if you sell right now, you pay 25% on that. Which is a lot of money! If you die, however, and they asses your property at $200,000, that becomes the new tax basis. There’s no “gain” because at the time of transfer to your heir, it was assessed at $200,000. If your heir sells at $200,000, there has been no “gain.” The tax basis steps up at death. That’s called the Step Up Basis.

The current administration is proposing to do away with the Step Up Basis. This is not unusual for a democratic administration. These propositions never seem to pass, but it’s important for you to know these things. Explaining all of these important 1031 exchange rules to your clients will help create urgency.

1031 exchange rules: how to quality

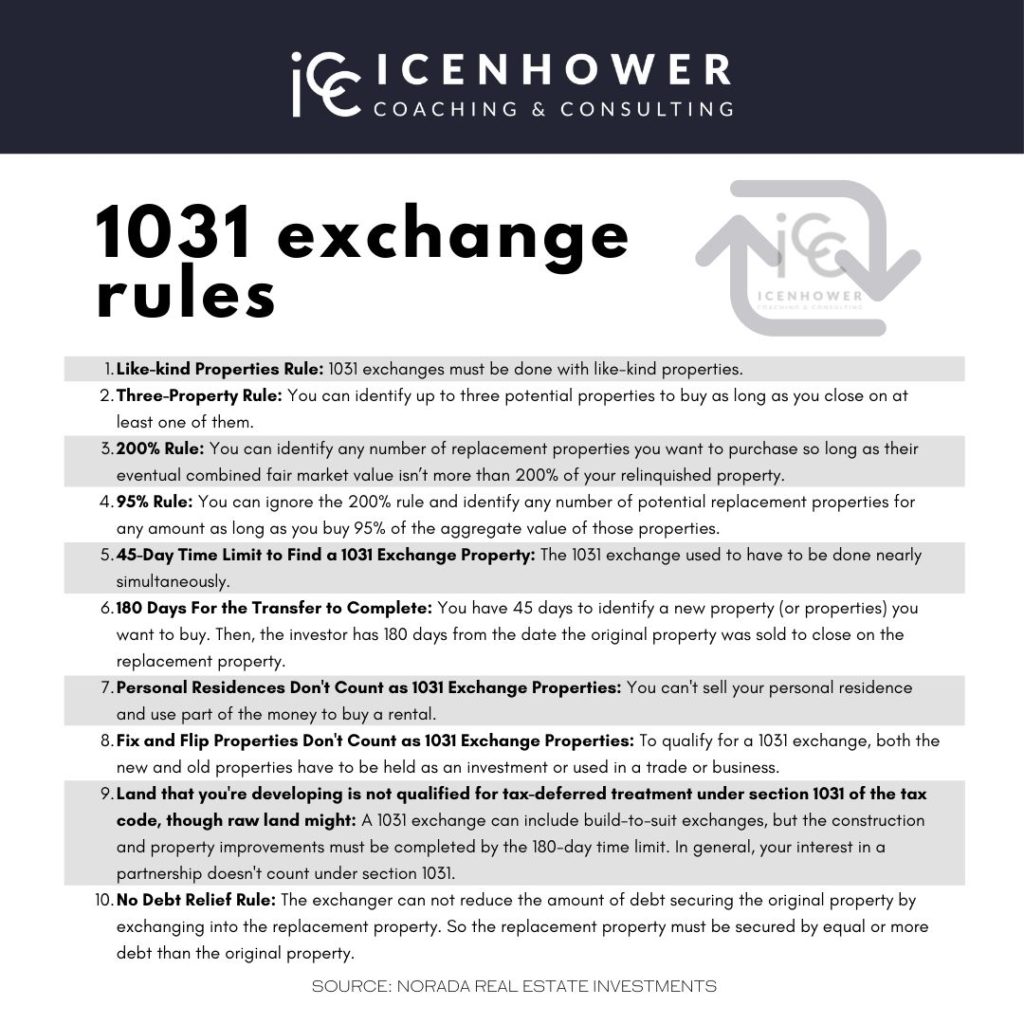

Here are a few of the 1031 exchange rules. For a full list of rules, see the graphic below, and feel free to share with your clients!

- Your property must be used for business purposes. You can’t do it with your personal residence or vacation home. Of course, unless you rented it out for at least two of the last five years. Your AirBnB could work depending on how much you use it.

- You cannot have debt relief. You cannot use a 1031 exchange to reduce your debt. So, if you own a property that’s worth $500,000, and you owe $300,000 on it, you have to carry debt of $300,000 or more on the property you exchange into.

- Timeframes. From the date that you close on the property you’re selling, you have 45 days to identify at least 3-5 replacement properties. And you have to pick one of those and close on them within 6 months of the closing date. That’s the hard part in this market. *Please talk to you Accomodator about these details for clarification, as these details do change and fluctuate.

Want to learn more?

- Be sure to watch the full video in this blog. Brian explains his knowledge and advice for dealing with 1031 exchange rules.

- Join the Real Estate Agent Round Table. We are always posting fresh content, including market updates, free templates, and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a form to fill out to subscribe. You’ll be the first to find out about our new resources, free downloads, premium online courses, as well as promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.

Check out our latest posts:

- How Realtors Manage Listings that Sit on the Market for Long Periods of Time

- How Real Estate Agents Can Write Better YouTube Descriptions for More Views & Leads

- Stop Losing Buyers – How to Effortlessly Get Buyer Representation Agreements Signed

- The Recruiting Flywheel: Designations, CE & Licensing That Attract Agents

- Homes Are Taking Longer to Sell – How Agents Keep Sellers Happy