Learn about the COVID-19 disaster relief programs and how real estate agents and brokers can apply to obtain financial support.

Real estate agents are now battling through the economic fallout due to governmental restrictions resulting from the Coronavirus, aka COVID-19. There are several options when it comes to disaster relief programs for Realtors during the COVID-19 crisis. Many agents are unable to work, or unable to work at the level that they need to.

Depending on where you are in the country, there are varying restrictions. These restrictions may limit your ability to perform services to the fullest extent. Due to the impact of the Coronavirus on the economy, the federal government, and many state governments, have created several different resources for financial assistance.

These disaster relief programs are NOT government “handouts”

It is important to get around that stigma. The government does not want you to avoid using these financial assistance programs. From their viewpoint, if you hunker down, circle your wagons, and freeze your business expenses, that hurts our economy. Instead, the government is hoping that you will take this financial aid and spend it. They want you to spend it on payroll, rent, and on whatever it takes to do business, depending on the disaster relief program you choose.

We can help stimulate the economy this way. The government is passing trillions of dollars of the stimulus. They need to find a way to disperse that throughout the nation’s economy, and they have chosen the Small Business Administration to be a significant part of their plan.

State unemployment agencies are also helping distribute these stimulus dollars. The government wants this financial assistance to be spread around, so the quicker we take advantage of it, the better. Not to mention, this makes good economic business sense for you. It’s important that you put on your business hat in this situation. This is not the time to try to take any supposed “moral high ground” and view it as a “handout.”

Realtors must take advantage of the disaster relief programs during the COVID-19 crisis

At Icenhower Coaching and Consulting, we coach the highest producing real estate agents, teams, and brokerages across America. Because of that, we are advising our clients to take advantage of these disaster relief programs. This will help us all move forward, be safe, and get the funds distributed as we move deeper and deeper into the economic fallout resulting from COVID-19.

Consult your accountant

I am going to be providing you with three different options for real estate agents, teams, and broker-owners to apply for disaster relief during the COVID-19 crisis. I want to emphasize that if you have an accountant or financial advisor, please consult them before you apply. You should make sure it is good for you and your business, corporation, or whatever entity you are operating under.

It’s good to know your options and to get business and tax advice from a professional accountant. In this article, I am speaking in broad terms. I don’t know all of the different tax implications state to state. That said, you should jump on this and consult your accountant in a hurry. Don’t wait on this. Do it today so you know which of these options is best for you.

The three options for Realtors applying for disaster relief programs in light of the COVID-19 crisis are Disaster Unemployment Assistance, a Small Business Administration Loan, and the Paycheck Protection Program.

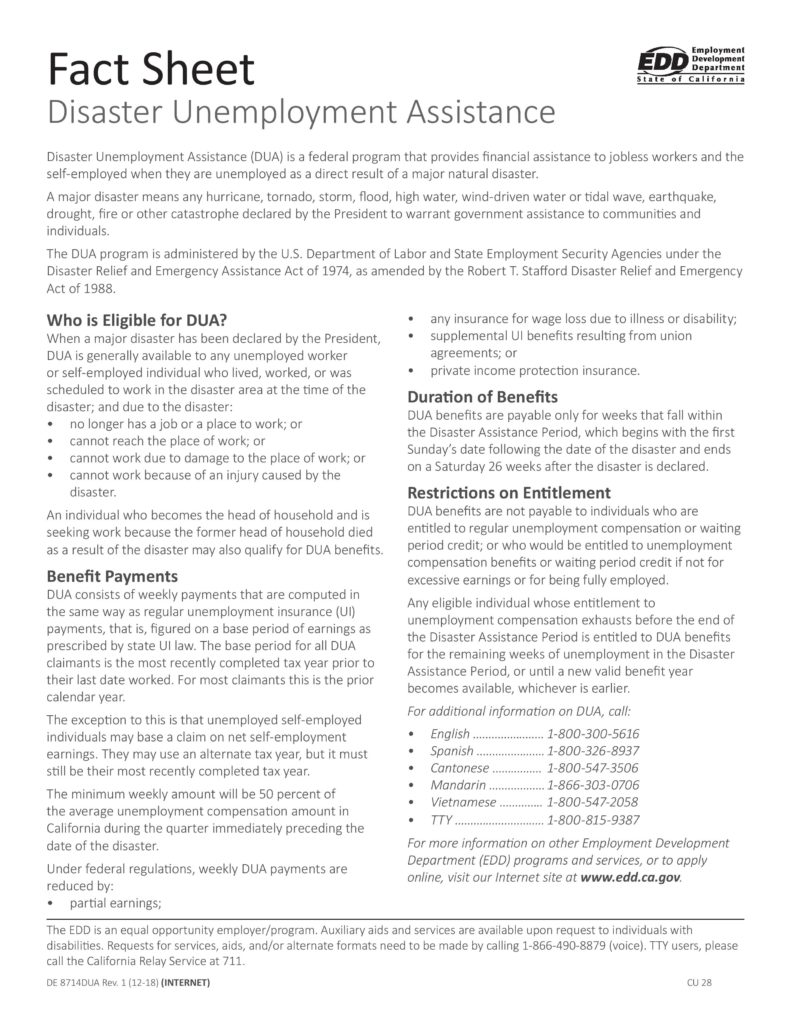

Disaster Unemployment Assistance for Realtors

The first disaster relief program option is through unemployment. This is great for solo real estate agents who are unable to work, or unable to generate enough business due to the economic fallout. This form will be different from state to state because your state government is responsible for distributing the federal economic funds. At the time of this blog, the government has started to distribute the funds from their latest two-trillion-dollar package through the Disaster Unemployment Assistance federal program. This provides financial assistance to jobless workers and the self-employed.

This applies to independent contractors – which includes real estate agents. You do not need to be a W-2 employee that’s laid off. For the state of California, you would go through the Employment Development Department of the state of California. Google “disaster unemployment assistance” for your local state. It will describe who is eligible. Most of the states have been declared disaster areas. In light of COVID-19, we are seeing that we can now apply for this disaster relief program.

There is going to be a flood of applications. So even though you should apply for that immediately, the funds probably aren’t available yet since it is so new. If you’re a solo agent, I would get in line for those funds now because this option is available to you. There are a lot of different numbers going around detailing how much you will get per week. I’m sure you have heard something by now. My advice is to apply right away, regardless.

Small Business Administration Loan disaster relief program for the COVID-19 crisis

The second program available to you is an SBA Loan. They have been accepting applications for two weeks now. It came out around March 20th and they recently amended it. I would recommend that solo agents try to apply for this. We have seen no proof that they shouldn’t. Team leaders and broker-owners of real estate franchises should definitely apply for this. You can apply directly through the Small Business Administration.

These loans are being funded through the first stimulus package initiated by the federal government to provide financial assistance during the Coronavirus crisis. Visit the SBA website and click on “apply for assistance.” This will take you to the disaster loan application. Again, most states are now a disaster area.

This started out as a straightforward disaster relief loan program. In the last few days, it was amended to include a loan advance of $10,000. The loan application is very streamlined and this will probably take you 30 minutes to fill out. Most likely, you’re an applicant with a business that has less than 500 employees. Go through the application and fill out all the required fields. It’s simple and fast.

This option will provide you with a loan of up to $500,000. That number will be based primarily on your gross receipts. So you will need to know what your gross receipts were for the last 12 months.

SBA Loan for solo real estate agents

For solo real estate agents, that number will include your gross commission income for the last 12 months. Next, the form will ask you for your cost of goods sold. For a solo agent, you’re not going to have much when it comes to the cost of goods sold. You might pay a stager, for example. If you pay a stager out of every sale, if you pay for a certain a photographer out of every sale, those would be considered your “cost of goods”.

SBA Loan for real estate broker owners

If you’re a real estate brokerage, you might have more in terms of the cost of goods. You’re going to have a gross commission income for the entire brokerage, and then from that income, you take in what you pay your sales agents. You’re going to have a really big cost of goods sold. The difference is going to be your net receipts and that’s what they’re going to base the total amount of your loan on.

This application does not ask us in real estate for expenses. So don’t be putting your expenses in here, believe it or not. They don’t want to know; that’s not one of the criteria on this loan application.

SBA Loan for team leaders

As far as a team leader is concerned, you may receive checks in and then payout commission splits. That is one way of doing it. Another scenario is if you take in only your commission generated from your sales, and then your brokerage pays the other agents directly. Or, a title, escrow, or closing company pays the other agents directly. In that case, you can use your gross receipts with no cost of goods sold.

Include any employees you have. If you’re a real estate team, you have an administrative assistant, for example. From a general standpoint, I’d probably try to get my employee count up as high as possible. The SBA is going to want to help those with employees.

Here’s how the SBA program works

The amount of the loan will be based on the gross receipts. The higher they are, the higher the loan amount may be. It can be up to $500,000. There is a 4% interest rate amortized over 30 years. Here’s the crazy part – they are saying that this could possibly be “forgiven.” I have not heard that this is 100% for sure, so I wouldn’t count on that.

However, even without “forgiveness,” this program is a very good option for financial assistance during the Coronavirus crisis. I do like the fact it’s a 30-year loan and the 4% interest rate. This is the option that will get you the most money at an extremely low-interest rate with a lot of flexibility on use. You’re not very limited on what you can and can’t spend that money on.

The other neat part about this SBA Loan program is that they can give you a $10,000 immediate advance, and they’re saying that you can have that money in a matter of three to five business days from filing. At the end of the application, they ask for your banking information so they can direct deposit it.

Getting your $10,000 advance

If you’re watching the news, you are likely hearing a lot of buzz about this. They are talking about getting the money out fast, and that’s why they created the $10,000 advance. With the $10,000, you are able to keep people employed and get the money flowing through the system. That gives the SBA time to get their information and documents together to review and approve or deny your loan.

Even if you don’t end up being approved for your loan, they are saying that the $10,000 is yours. They want you to spend it. If they don’t approve of you for whatever reason, you still get to keep the $10,000. You don’t have to pay it back if you are denied the loan. If you do get the loan, the $10,000 is an advance of $10,000 against the total amount of your loan.

So, if you end up getting a $500,000 loan, you will receive the remaining amount after you sign the paperwork. The contract will be tied to your corporation, LLC, your sole proprietorship, or whatever entity you work under.

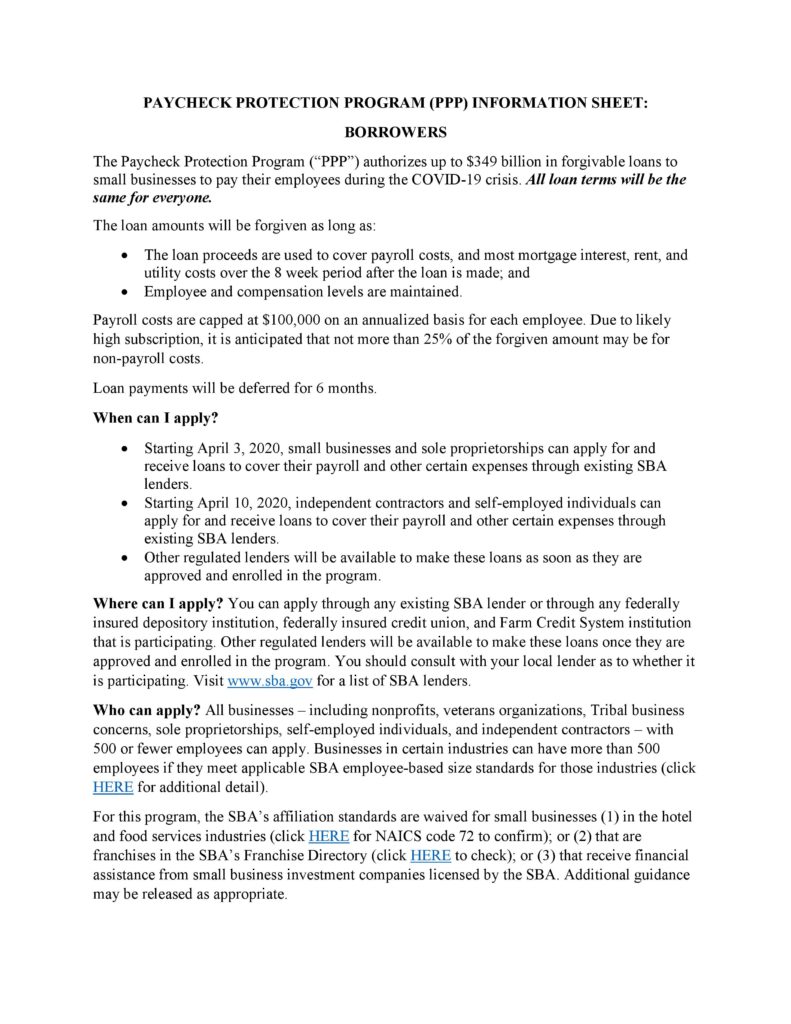

Paycheck Protection Program (PPP)

The third option for COVID-19 disaster relief for Realtors is the Paycheck Protection Program or the PPP. The PPP program is also through the SBA. That said, you don’t apply directly to the SBA. The PPP program is the brand-new program that just came out of the Cares Act signed by the US federal government at the end of March. Friday, April 3rd is when applications will be taken by the SBA. The money is going to come from the SBA, but the application process is through your local bank.

Depending on how big your bank is, you may have an online application that you can fill out. If your bank is small, it may not have an online application. They may require you to use the SBA form and then turn it into the bank. Then the bank will upload it to the SBA. Many of the larger banks are creating their own website. This is due to the high traffic they have been experiencing while people apply for financial assistance during the Coronavirus crisis.

Applying for the Paycheck Protection Program (PPP) diaster relief during COVID-19

The PPP form is not long – it’s only four pages, just about the same length as the other applications. The form that you do through your bank (which may be available online) is designed to be streamlined and very quick. What you will need to know is your average monthly payroll. How much do you pay on an average month? That’s the big determinant here, as well as the number of jobs you have.

If you’re a solo agent and you don’t pay anybody regularly or on payroll, this program is probably not for you. This program is going to be for the larger real estate teams and real estate brokerages because it is determined by your payroll. They look at your average monthly payroll. They want you to determine the average from the last 12 months and then they will have you multiply it by 2.5. That will give you a dollar amount, and that dollar amount is the amount that they will loan you.

Details about the Paycheck Protection Program (PPP)

This PPP is a two-year loan and the interest rate is pretty low. They’re saying it’s going be 0.5%. That said, it’s only a two-year loan, so you’re going to be making some really steep payments. You have no payments due for the first six months, so they give you that amount of time. Then you’ve got two years to pay the loan off.

Here’s the trick with the PPP. If you do not lay anybody off during this time, and you use the loan for payroll, rent, or your mortgage and utilities (all the things that keep your business afloat), your loan will be “forgiven.” That is the attractive part of the PPP. This is why it is called the “Payroll Protection Program,” because it’s protecting your payroll so you don’t need to lay people off. Check with your bank on Friday, April 3rd, and get that application. Either use the paper application if it’s a small bank, or you can go online to apply for the larger banks.

Cover your bases: Apply for every program you can for disaster relief during COVID-19

We are telling our clients here at Icenhower Coaching and Consulting to apply for each program that they qualify for. There are rumors that you cannot accept both the SBA Loan and the PPP. At the same time, a lot of experts are now saying that you may be able to receive both concurrently. I have not read anything definitive either way.

In today’s environment, changes are coming into effect every week after they roll out these programs. Apply for both programs now and decide later which one you want to accept.

You also don’t know the amount you will receive from each program. You might make your decision based on those amounts once your applications are accepted. So, I would apply for both. Before you sign anything or you promise to pay anything back, look at the terms. We don’t know which plan will end up being better at this point. You may as well cover your bases and make the choice after you receive both offers.

Realtors: Help yourself and help the economy get through this COVID-19 crisis by applying for disaster relief programs

As Realtors, it is prudent right now for our country that we do apply for these disaster relief programs in light of COVID-19. We need to disperse these funds that the government is pumping out for us. I think it’s important that we’re honest on these applications and that we use them for the right reasons. We can do our part and help our economy while helping our own business survive at the same time. We can get through this!

More Coronavirus Content:

- The Social Media vs AI Real Estate Marketing Battle – Which Will Win?

- Why Generic AI Prompts Are Killing Your Follow-Up — And How to Fix Them Using Perplexity AI

- How to Coach Real Estate Agents Using DISC Behavioral Assessments

- The Real Estate Agent Burnout Problem — And the Simple Habits That Fix It

- Are Real Estate Teams Dying Off? How the Strong Survive