Learn how Realtors should analyze a real estate profit and loss statement by comparing it to a real estate agent budget to ensure that their income, expenses, and profit are all in alignment with a successful and proven model.

Now that we have gone over a sample real estate profit and loss statement, time to apply what we learned. Today we are going to diagnose the problems we can identify in the Sample P&L Statement, demonstrating how you can do this with your own P&L.

If you like this content but need more help, be sure to enroll in our online course, Agent Financials.

VIDEO: How to Analyze a Real Estate Profit and Loss Statement

Analyzing a real estate profit and loss statement

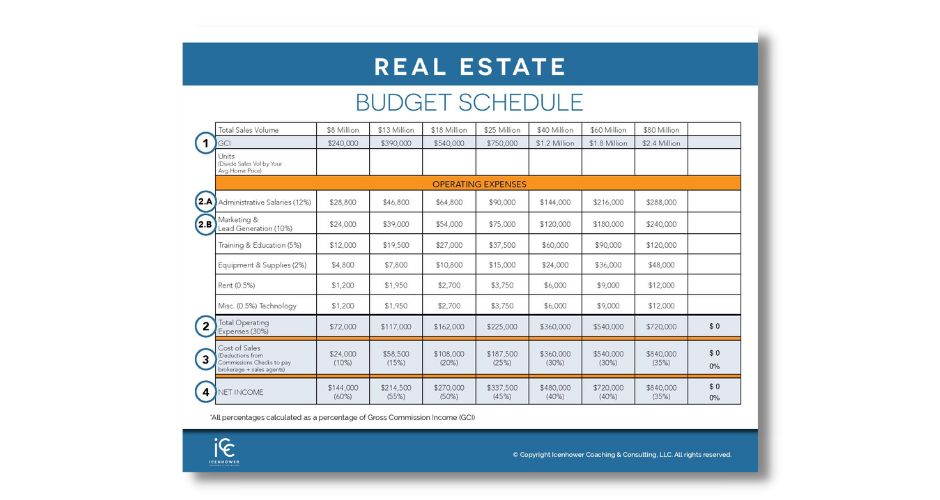

Now that we understand how to use the Real Estate Budget Schedule and the Profit & Loss (P&L) Statement, let’s dive in on how to analyze this data. This is where the magic really happens. This is where you go next level.

What can you learn by looking at the Sample P&L?

Let’s continue to use the Sample P&L as we learn about how to analyze the data. And, let’s pretend that this is your P&L Statement, for the sake of this example.

Use the real estate profit and loss statement to identify key issues

- The commission split is very low. It is at 33% of GCI. This should be closer to 50%. It is 17% low.

- Operating Expenses are too high. Right now, it is at 36% and it should be closer to 30%. Admin salaries, which should make up 10%, are at 13%.

So, what could this mean? It could mean a lot of things. Let’s look at the Real Estate Budget Schedule to see where you are at.

Diagnosing the problem

It could mean, for example, that you have just hired a bunch of people and you haven’t received the income from adding them to the team yet.

It could be the Cost of Sales. Are you paying too much to your agents? Maybe you’re paying too much to your broker or your team leader. From the P&L we can see that the Cost of Sales is at 22%, so let’s refer to the Real Estate Budget Schedule to see how that lines up.

With the GCI in the Sample P&L of $454,033, you are somewhere between the second and third column on the Real Estate Budget Schedule. You are growing and pushing to column 3. So we can see where the numbers fall in comparison to both columns.

If we look at the third column, we see that Cost of Sales should be around 20%. So, your Cost of Sales at 22% is a little higher than even what the third column would allow. You should probably be closer to something like 17% … between the 15% of the second column and the 20% of the third.

Most of the expenses fall in (or beyond) column three, and yet the GCI is between column two and three.

What you can learn from your real estate profit and loss statement

This isn’t a huge deal. But, this tells me that you are going to put a red light on expenses. If you are operating at (or slightly beyond) budget, you put up a red light. No more spending

When you get the green light for expenses again, you need to be smart and hire right away to keep things in balance. If your profit margin gets too big, you also lose.

We know where our admin salaries and our marketing expenses are, so what is making up the rest of the expenses? To further diagnose the issue, it’s also important to go through, line by line, and learn what the other expenses are.

Recommendations

In this Sample P&L, if we say that you are the agent, I would say you’re not too far gone. You’re not in a very bad position. You’ve led with expenses, and that’s not necessarily a bad thing. You just need to now focus on getting your GCI up to snuff and back in alignment with your Real Estate Budget Schedule.

Your profit margin is slim. You are at 36% instead of 50%. Once you generate more business and increase your GCI, your percentage will go back up. And then you can hire again and continue to grow your team.

Why do you need a coach?

This is why most real estate agents need a coach. Coaches can help you do uncomfortable things that you need to do in order to succeed and grow.

There are two obstacles that agents need help with the most. These two types of uncomfortable behavior hold most agents back from growth.

This is why most real estate agents need a coach.

The first uncomfortable behavior is an activity like putting together an SOI database, calling your SOI, hosting a client event, analyzing your P&L, etc. These are all things you wouldn’t do unless a coach holds you to it.

And the second is spending money to invest in your business. Hiring a coach, hiring an admin, paying for marketing, etc.

Use a model that works for your real estate profit and loss statement

A coach can get you through this and help you build confidence in doing these uncomfortable behaviors. We know what the top teams do! I can create a model like the Real Estate Budget Schedule and tell you that I know it works because it is the model that the top teams across North America use.

There of course are other coaching companies out there that coach on similar things. Not many of them coach on budgets or financials. This is one way that ICC sets itself apart from the competition.

This is one way that ICC sets itself apart from the competition.

Data-driven decisions with support

Support from a coach can give you the confidence to move forward instead of living in your fear. Dealing with budgets and P&L statements can be scary, so it helps to have a coach that can guide you through the process and coach you on action steps to use the model as a road map for growth.

As you move from left to right in the Real Estate Budget Schedule, you get more than just increased Net Income. You also get more time. People tend to forget about that. It’s about more than just your bottom line. Your work/life balance improves.

Take the online course to learn more about your real estate profit and loss statement

When you learn how to follow the simple steps I’ve outlined in this course, it really is quite easy for you to keep on top of your financials. You have the ability to check in as often as you’d like and look at your P&L Statements against your Real Estate Budget Schedule. In this course, you gain the knowledge and the tools you need to make the necessary changes and start managing your financials right away.

FREE DOWNLOAD: Real Estate Budget Schedule Template

This week, we are giving subscribers a FREE copy of our Real Estate Budget Schedule Template. It’s a fillable form that you can use based on what you learned in today’s blog.

If you need more training on how to manage your financials, be sure to enroll in our online course, Agent Financials.

Want to learn more?

- Read The High-Performing Real Estate Team. You can buy Brian Icenhower’s best-selling book on Amazon.

- Subscribe to The Real Estate Trainer Podcast. You can find it on Apple Podcasts, Google Podcasts, Spotify, Podbean, and anywhere you listen to your favorite podcasts.

- Join the Real Estate Agent Round Table. We are always posting fresh content — everything from market updates to free templates — and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a subscription sign-up form. You’ll be the first to find out about our new resources, free downloads, premium online courses, and the latest promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.