Managing Money for Real Estate Agents - Use these 4 tips for Realtors to effectively manage their finances to create wealth from their businesses.

This blog will teach you 4 top tips for managing money for real estate agents.

Welcome to our comprehensive guide on “Managing Money for Real Estate Agents”. In this article, we’ll explore the essential strategies and practices for real estate agents to effectively manage their finances. This topic is crucial, especially considering the unique financial challenges faced by agents in their line of work. Let’s dive into the four key areas that are pivotal for financial success.

Be sure to listen to this episode of The Brian Icenhower Podcast and subscribe to the podcast so you never miss an episode!

VIDEO: Managing Money for Real Estate Agents – The 4 Keys

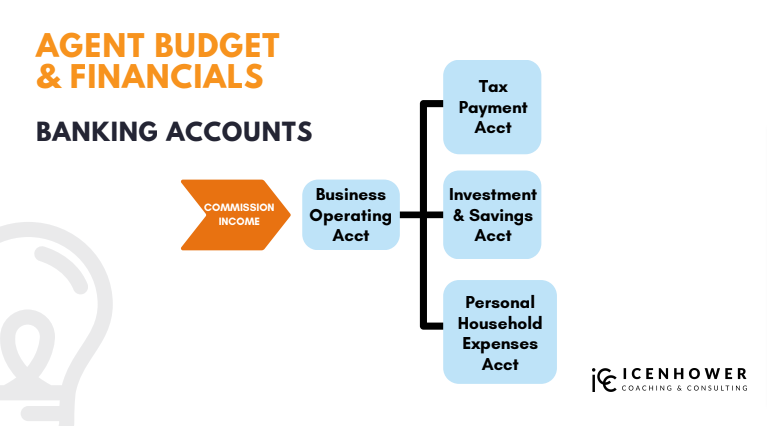

1. Establishing a Structured Banking System

A structured banking system is the foundation of financial management for real estate agents. This system involves setting up four separate bank accounts, each serving a unique purpose:

Business Operating Account

This account serves as the primary hub for all business-related income and expenses. It’s essential for maintaining a clear separation between your professional and personal finances.

Tax Payment Account

Dedicated to handling taxes, this account should be funded monthly in advance. By doing this, real estate agents can better manage their tax liabilities and avoid year-end surprises.

Investment Savings Account

This is where agents save for future investments, such as rental properties or stock market opportunities. Regular contributions to this account are vital for long-term wealth accumulation.

Personal Household Expenses Account

This account is for managing personal expenses that are non-deductible for business purposes. Keeping personal spending separate helps in maintaining a lean budget and focusing on wealth-building.

By using these four accounts strategically, real estate agents can streamline their finances, prepare for tax obligations, invest wisely, and keep personal spending in check.

2. Prioritizing Wealth Management Over Vanity Metrics

It’s common in the real estate industry to focus on sales volumes and awards, but these vanity metrics do not always correlate with financial success. Effective money management for real estate agents involves prioritizing net income growth and wealth accumulation over mere production numbers. By doing so, agents can ensure they are not just earning more but also retaining and growing their wealth.

-

Quick View

1×1 Solo Agent Weekly Coaching Program

$1,000 / monthThis 1×1 Solo Agent Weekly Real Estate Coaching Program designed to help you increase your production and your commission income with strategies and systems for sustainable business growth.

3. Proactive Tax Planning and Management

Proactive tax planning is a critical aspect of managing money for real estate agents. Instead of waiting until the end of the year, agents should work with a full-service accountant to make estimated tax payments throughout the year. This approach allows agents to adjust their tax strategies in real time, based on their current financial performance, thereby maximizing their opportunities to reduce tax liabilities.

4. Balancing Business Growth with Personal Time

Achieving a balance between increasing income and having personal time is essential. The goal is to not only grow your business but also to have time for family, hobbies, and personal interests. This balance is crucial for long-term success and personal well-being.

A well-planned budget is crucial for eliminating the common financial ups and downs in real estate.

Brian Icenhower

Conclusion: Managing Money for Real Estate Agents

Managing money effectively is a critical skill for real estate agents. By establishing a structured banking system, focusing on wealth management, engaging in proactive tax planning, and balancing business growth with personal time, agents can secure their financial future. This approach not only aids in building wealth but also ensures a fulfilling career in real estate.

Remember, it’s not just about working harder but working smarter. By implementing these four keys, real estate agents can pave the way for financial stability and success in their professional and personal lives.