Use this buyer consultation script for Realtors with clients in competitive markets to set proper expectations and prepare buyers for multiple offer negotiations.

What buyer consultation script do you use with your buyers to help prepare them for what’s to come in this current low-inventory market? There is a lot of frustration on the buyer side of transactions right now. If you’re working too hard on the buyer side of transactions, you’re doing something wrong. This is the easiest market to represent buyers in. In a nutshell, you shouldn’t be showing any property. Maybe just a few homes, at the most. If you’re showing a lot of properties, you are doing your clients a disservice right now.

VIDEO: Buyer Consultation Script for Realtors in Multiple Offer Markets

Set proper buyer expectations up front

We are moving into a massive appreciation market. It’s important that we understand why that is so we can intelligently explain it to our buyers. This is not an “if” or a “maybe” … this is happening. The housing supply is so low and the demand is so high that it would take a very, very long time for them to get back into alignment again.

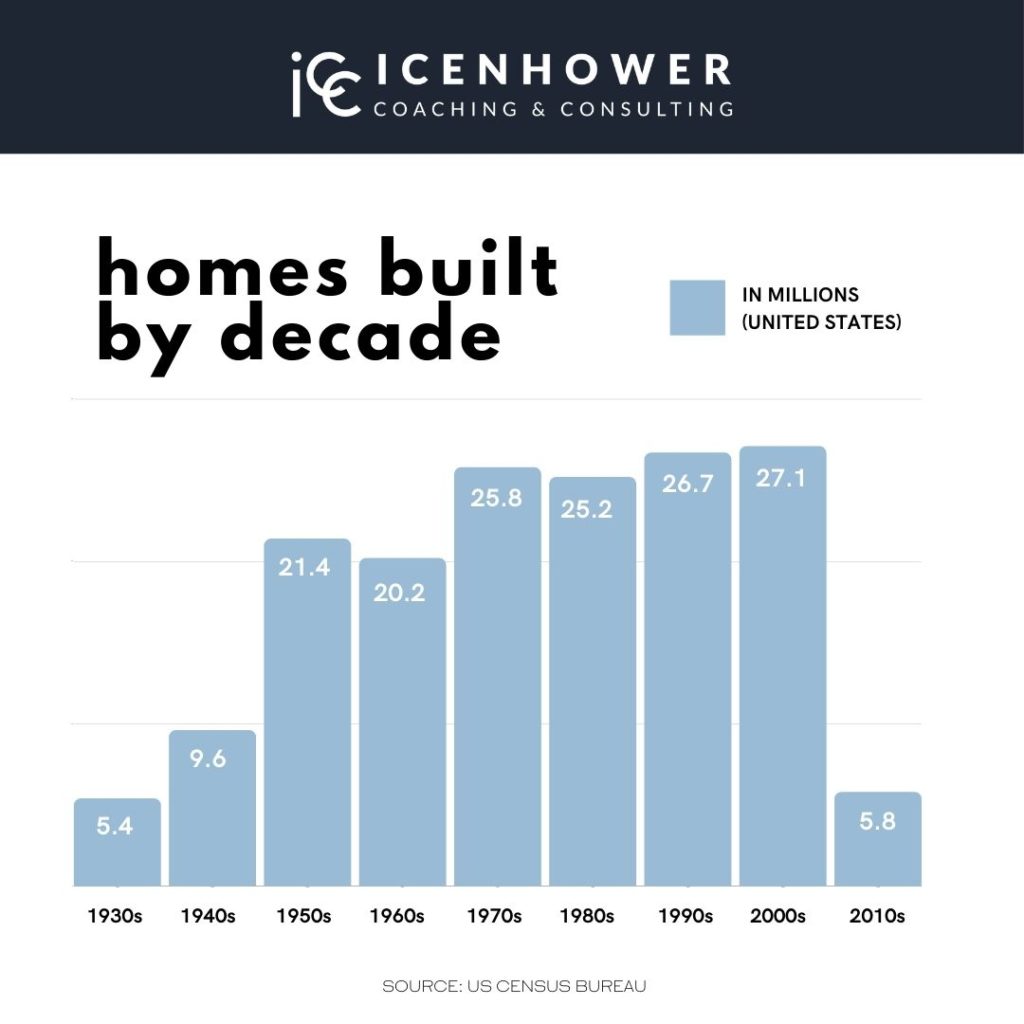

As a part of your buyer consultation script, share infographics, like the one above, with your buyers. This shows the houses built by decade, and you can see the steep drop-off that happened in the 2010s. This is the major stat that most real estate trusts and hedge funds are relying on right now. We virtually stopped building houses back in 2007, 2008, and 2009. Housing builders got spooked or they went bankrupt. Builders started building at a much smaller scale. As a result, our housing supply dramatically dropped. This infographic extinguishes any argument about being in a housing “bubble” right now.

When your buyers say, “I think I’ll wait for housing prices to come back down,” you can say with confidence, “They will not.” This must be a part of your buyer consultation script. It’s not a fun conversation to have, but it’s the truth. And you must share the truth with your clients.

“Smart money” vs “dumb money”

“Smart money” is a term I use to refer to hedge funds, real estate investment trusts, massive institutions, etc. They are buying most of the houses across the country right now. And, these “smart money” players are the ones to watch and listen to right now. They are hedging against inflation. On the other side of the coin, there is “dumb money,” and these are the buyers who say they are going to wait for prices to drop. “Dumb money” is anyone who isn’t a professional investor. Regular people buy off of emotion. These are your buyers! It’s our job to take “dumb money,” educate them, and get them to follow the “smart money.”

Use your buyer consultation script to educate your buyers

How do you fight the emotional urge that buyers have to “wait until prices come down”? You educate them. You do this through your buyer consultation. Tell your buyers what they need to know, and more than that, show them. Show them through infographics woven into your buyer consultation script. Supply and demand rule the market. Everything else is distraction, and you must show your buyers this.

Show fewer houses, write more offers

If you feel busier and more stressed out than ever representing buyers, you are doing something wrong. As I mentioned earlier in this blog, this is the easiest market in which to represent buyers. You should not be showing many, if any, houses. Yes, you are vigorously writing offers — but this is the easy part of your job! It’s showing houses that always takes the most amount of time. In this market, you should be writing tons of offers, and once an offer gets accepted, then you show the property for inspection, etc. Of course, you will find exceptions where there is time to see the house before an offer is accepted, but this is becoming more and more rare.

Get your offers accepted

Here are a few tips and ways that I’ve found my offers get accepted in this market. If you write offers with these elements included, you will have a higher chance of your offer being accepted in this current low-inventory market.

- $500 EMD (Earnest Money Deposit). “The minute you accept this offer, you get $500 released to you in cash.” You would not believe how enticing this is to sellers! No matter what, if they accept the offer, they get $500.

- In ten days, I will provide an increased, non-refundable deposit of $500. Listing agents love this because they have ten days off the market, and I have ten days to get in there.

- Waive all inspections and contingencies. I have ten days to figure out if I want to buy it or not.

- Waive appraisal.

This is how most hedge funds and real estate investors write offers. Again, follow the “smart money” clues. These are the offers you are up against in this market. Yes, most of them are also over asking price. But with all of the other sweet parts of the offer, it doesn’t have to be incredibly over asking. Share this information with your buyers during your buyer consultation script. These tips will help you write better offers on their behalf.

Educating your buyers will work wonders for getting your offers accepted. Yes, your buyers may be stubborn at first and not think they need to follow all of your advice. But after writing a few offers and not seeing success, they will realize you were right about how aggressive they need to be in this current market. Suddenly, they aren’t blaming you, they are blaming themselves for not following the wise advice that you gave to them during your buyer consultation.

Talk about escalation clauses in your buyer consultation script

If you are in an area that accepts escalation clauses, you may need to use them on top of the tactics listed above. These days, in markets that permit escalation clauses, they are a dime a dozen. Everyone is using them. So, you must use them, too, in order to stay competitive. Mention this to your buyers during your buyer consultation script.

Remember, not everyone can buy a house in this market

This is tough. In this low-inventory market, there are buyers who won’t be able to buy a house. Some people won’t be able to pay over asking, or add an escalation clause. Right now we have about 75% home ownership in the United States, and we are going to see that go down to about 50%. A lot of people are going to get priced out. Understand that you can’t help everyone and it’s not your fault!

Giving bad news isn’t always easy, especially depending on your DISC behavioral profile. But this hard conversation must happen up front during your buyer consultation. One way you can try to help buyers is by asking if they have any family members that can help them out with cash. In your buyer consultation script, you must explain to your buyers that if they need a loan, their offer is not “clean” anymore. You’ll almost always be up against cash offers. Most buyers will feel uncomfortable asking a close friend or family member to borrow money, so you can help them by providing this script.

Hey, I need to borrow money to buy a house cash. Then I will refinance it. Here is my preapproval letter for financing. I need to borrow [amount of cash] and I’ll need it for about 90 days. I will pay you back [amount of cash plus a little more than you borrowed].

Have a few hard-money investors in your queue

This is another tip for a buyer that needs to use a loan. You can find hard-money investors locally. This is another source for financing, and you can often close in ten days. Private financing allows for this kind of speed, which makes your offer more enticing than a conventional loan. This is as good as cash to a seller. Talk to a local house-flipper or home builder and they will know several hard-money investors for you to talk to.

Need more help?

- Sign up for the Buyer Lead Conversion online course. In this condensed course, you’ll learn all the ins and outs of getting buyers on your side. We’ll teach you how to approach and address buyers’ unique needs, get them in the door for a proper appointment, make the most of your consultations with buyer consultation scripts, and, of course, how to seal the deal by signing an exclusive agreement.

- Join the Real Estate Agent Round Table. We are always posting fresh content, including market updates, free templates, and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a form to fill out to subscribe. You’ll be the first to find out about our new resources, free downloads, premium online courses, as well as promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.

Check out our latest posts:

- Admin Overload Isn’t a Staffing Problem — It’s an Automation Problem: How AI Transforms Your Listing Manager

- Real Estate Team Recruiting “I’ll Lose My Identity” Objection

- The Social Media vs AI Real Estate Marketing Battle – Which Will Win?

- Why Generic AI Prompts Are Killing Your Follow-Up — And How to Fix Them Using Perplexity AI

- How to Coach Real Estate Agents Using DISC Behavioral Assessments