Use this free PDF Download of the Realtor budget template to help real estate agents manage their financials and compare their profits and expenses to industry standards.

Today, I’m going to show you a Realtor budget template. This template, if followed correctly, will help guide you as you make your financial decisions for your real estate business. Used alongside your P&L Statement, you will be able to see if what you’re spending is appropriate for the level of GCI you are at. And, you will be able to diagnose your problem and make the changes needed to get back on track.

Stop looking out the rear view mirror with your finances. It’s time to look forward, out your windshield, and make calculated, growth-based decisions.

And, if you’d like more guidance and step-by-step help on how to manage your financials, check out our online course, Agent Financials.

VIDEO: Realtor Budget Template – Free PDF Download

This Realtor Budget Template Really Works

Let’s talk about what your Realtor budget should look like based on the helpful template referenced in this video. (Hint: We’re also giving it away today FREE to subscribers!)

We’ve already talked about how to manage your financials and master your accounting practices.

A real estate agent’s budget is what defines the future growth capabilities for the agent. It’s crucial. The budget itself is simple, and it works for all different agents. I don’t care about your production because it’s all based on percentages. From a new agent to 300 million in sales volume, this budget model will still work for you.

A real estate agent’s budget is what defines the future growth capabilities for the agent.

Our Realtor Budget Template: “Real Estate Budget Schedule”

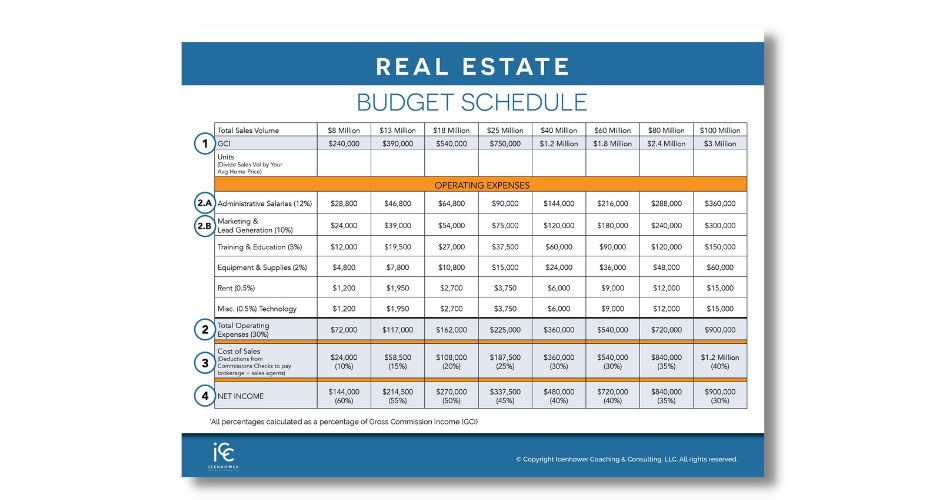

I’m going to break down the different important parts of the Real Estate Budget Schedule, below, so you can learn more about what each section means, and how to think about it as you use it.

You’ll notice in the Real Estate Budget Schedule that I have some bold numbers in the left margin of the chart. These are important and will help tie in the Profit & Loss Statement that we will go over later.

You’ll also notice that I have four rows that are shaded gray. These are the four most important numbers to know when creating your budget. We look at these areas in order: 1, 2, 3, and then 4.

The most important number is 1 – GCI, or Gross Commission Income. This is how much GCI you get.

As you move across from column to column, the goal is to have you work less and earn more net income.

Rows of the Realtor Budget Template

Total Sales Volume – This is the total sales volume an agent does. First column is $8 million, then you work all the way across the table to $100 million.

GCI – Just because you have a certain sales volume doesn’t mean your GCI will necessarily line up here. You may have less than that because your aren’t holding the line for your commission percentage. It should be at about 3% of your Total Sales Volume. Note that all the percentages listed below are percentages of the GCI amount here.

Administrative Salaries (12%) – This is the percentage of GCI that you should be using toward administrative support. As your Total Sales Volume increases, this number will increase, as does your need for admin support.

Marketing & Lead Generation (10%) – This is what brings you business, and should always be about 10% of your GCI. If you are well under budget here, that means you are going to have a hard time moving across the chart to the next column and earning more money through sustainable growth.

Total Operating Expenses (30%) – This is all of your operating expenses combined and should total around 30% of your GCI. Notice that of that 30%, more than two thirds comes from admin salaries, marketing, and lead generation. There are almost no other operating expenses.

Cost of Sales – These are deductions from commission checks to pay your brokerage and your sales agents. Royalties, franchise fees, commission splits, caps, all of these fees go here. You don’t pay anything here unless you close a transaction.

Net Income – This percentage goes down as you move right, but the total number goes up. This is the income you take home after all expenses have been taken out.

Invest in your business in order to grow your business

Agents tend to get stuck in not wanting to spend on marketing, lead generation, or administrative support. They won’t make these operating expenses, and yet they wonder why they can’t seem to grow.

A lot of times, these agents feel that they are a warrior. They aren’t using this Realtor Budget Template so they don’t understand how the numbers work. These agents want to do it all, and keep the money for themselves. They might pay a transaction coordinator by the file, but they don’t have anyone they are paying every two weeks with a salary. That’s because most agents are scared of paying a salary.

A chief invests in their business.

The budget you use will give you confidence in investing in your business. You need to know where to spend your money (and how much) and you need to know that these figures will work for you.

That’s why we are here today. I’m teaching you the system that we teach all of our coaching clients. This is what takes our clients and turns them into top producers.

The first thing an ICC coach does with a client is budgeting. Then we will check your Operating Expenses every quarter to make sure that you’re not exceeding 30% by too much at any time.

Expenses

You have two major expenses, really. Cost of Sales and Operating Expenses. And, the Operating Expenses mostly come from administrative salaries, marketing, and lead generation.

The difference between the Cost of Sales and the Operating Expenses is that you will have to pay your Operating Expenses regardless of how many closings you do each month. These are not tied to a transaction. If you don’t close anything, you’re still paying this. A Cost of Sales is always tied to a transaction. It’s tied to your commission check.

Your GCI is the total amount before you pay your brokerage. If you pay a cap, you have to add that on to your GCI. Your Net Income is after you pay your sales agents, referral fees, brokerage fees.

Change your mindset around expenses

Here’s the thing to remember, especially for anyone who is focused on keeping a low commission split. You’re going to be low on the totem pole in business if you keep this mindset. The richest people in the world have the lowest profit margin. You can see how this is true if you look at our Realtor Budget Template.

The richest people in the world have the lowest profit margin.

Some of the highest-performing agents I know thrive with a Net Income that is less than 30%. If you want to run a successful brokerage someday, you’ll be at under 10% in your Net Income. You’ll have expenses all over the place. And this is a sign of success! Because your Net Income will be higher.

Here’s what you need to do to use this Realtor Budget Template

- Find out your GCI (You may need to talk to your broker and/or your team members to get an accurate total here.)

- Figure out your Operating Expenses (You can get this from your Profit & Loss Statement.)

- Figure out your Cost of Sales (This is how much you paid your agents and how much you paid your brokerage, etc., from your commission.)

- Your Net Income will be decreasing based on profit margin, and that’s okay – that’s the goal! But the number itself will go slowly up as you move right.

Fine-tune these numbers to reflect the correct percentage based on the column you belong in, and you will be able to use it as a guide to make sure you are on track with your expenses.

Now, you should start to understand how real estate teams grow. I say it all the time, and I’ll say it again: Success follows clues. When you follow the Real Estate Budget Schedule as a guide, it will keep your numbers in alignment with how you can grow. Your Net Income will increase, as will your expenses, and these percentages will guide you to make sure you are spending in the right areas to achieve sustainable growth.

FREE DOWNLOAD: Realtor Budget Template

This Realtor Budget Template is FREE today for subscribers. Use this template to see exactly where your numbers should be, and where you are “off”. Then, use what you learned in today’s blog to help determine “why” and make the changes necessary to get back on track for growth!

If you need more training on how to create a budget that actually works, be sure to enroll in our online course, Agent Financials.

Want to learn more?

- Read The High-Performing Real Estate Team. You can buy Brian Icenhower’s best-selling book on Amazon.

- Subscribe to The Real Estate Trainer Podcast. You can find it on Apple Podcasts, Google Podcasts, Spotify, Podbean, and anywhere you listen to your favorite podcasts.

- Join the Real Estate Agent Round Table. We are always posting fresh content — everything from market updates to free templates — and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a subscription sign-up form. You’ll be the first to find out about our new resources, free downloads, premium online courses, and the latest promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.