Accounting for real estate agents – this is likely a topic you have avoided your entire career. Fact is, most agents “wing it” and only deal with their financial situation at tax time. But you know what else is true about most real estate agents? They aren’t top producers.

You know what the top producers do? They have an accountant. And that accountant is their CFO. Top producers have a system that allows them to stay ahead of the ball on their finances and make smarter choices as a result. If you’re tired of feeling “broke” all the time, despite closing a lot of transactions, then listen up. Let’s dive into accounting best practices for Realtors.

If you want more step-by-step help on this topic, along with the resources and guide to start implementing better financial practices in your business today, check out our online course. You can enroll here.

You need two important systems as you begin to manage your financials.

Most agents – 80-90% of the agents out there – struggle to get business because they “can never afford anything.” You may feel frustrated because you never know how much money you have “in your pocket.”

You may feel frustrated because you never know how much money you have “in your pocket.”

You never know if you can afford to go to that conference, or if you can afford to spend on the new marketing you need. Maybe you aren’t sure if you can afford to pay an admin or hire a coach. Things feel “tight” and you may have not had a closing in a few weeks so you’re on edge. Or the market shifts and you are worried. Your accountant isn’t really experienced with accounting for real estate agents, so you are going it alone.

A lot of agents run their business based on emotion. Instead of relying on logic and numbers, many real estate agents go based on how they “feel”.

You aren’t making decisions based on a P&L or a budget. You are not making logical decisions in your business. A basket case is running your business – and that basket case is you!

A basket case is running your business – and that basket case is you!

Of course, nobody believes that emotion should dictate the course of their business. A budget and a P&L statement is necessary NOW, not when you finally get enough business, or when you feel like you are bringing in enough income to justify one. It is never too early to know your financial models.

Things have changed a lot in real estate. There was a time, 5-10 years ago, when I used to tell people to manage their own Quickbooks and spreadsheets. I would show them how, give them forms, help them itemize all their expenses and spreadsheets. Back then, this was part of the training I would provide to my clients.

Accounting for real estate agents has become so simple. All because of a magical technological advancement. Banks started providing online banking and granting accountants administrative access into their client’s bank accounts.

Now, your accountant can actually do accounting for real estate agents. They can easily keep you updated on your financial situation.

You need an accountant to not only prepare your taxes but also to act like the CFO of your business. Accounting for real estate agents is more than tax prep. You don’t want to always be looking at your rear view mirror. You want to be able to look out in front of you to dictate where you’re going. Your accountant must be more than a CPA.

You want to be able to look out in front of you to dictate where you’re going. Your accountant must be more than a CPA.

Throughout the year, your accountant will be checking on your accounts. They will have administrative access and be able to check periodically. Your accountant will have a lot of questions at first because your accountant isn’t familiar with your expenses and your specific setup but, in time, it will get easier. They will become familiar with what everything means in your accounts.

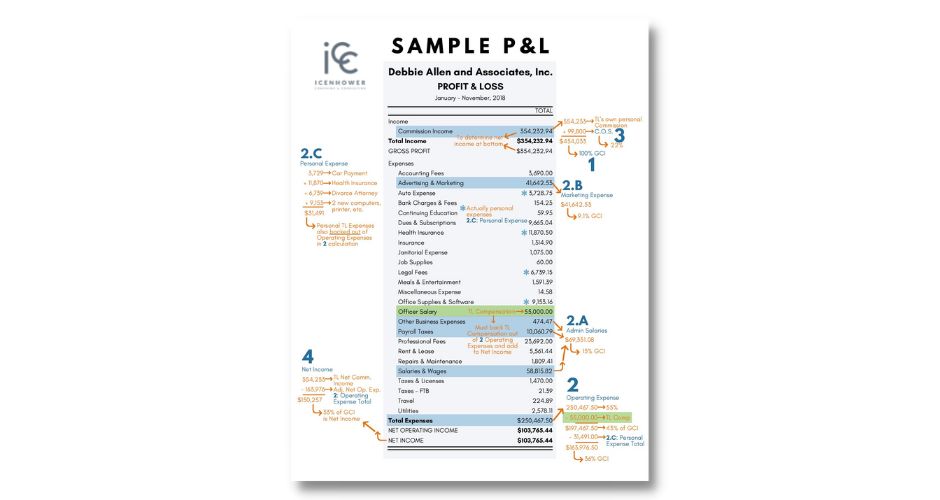

Every quarter, you want your accountant to generate a Profit & Loss Statement for you. This statement will allow you to see where you are at. You can see whether you are ahead or behind, and why. You can then make adjustments before the “damage is done” and you can effectively stay ahead of the ball this way.

Once you begin to meet regularly with your accountant and you know your profit and loss for each month, you can begin to feel more confident and comfortable with your finances. And once that happens, you can begin to make empowered decisions to grow your business. You will have a working budget that helps shape the choices you make. You will have less fear wrapped around your income, and certainly around taxes.

Start looking out the front windshield instead of your rear view mirror. You need to get comfortable with your financials.

Start looking out the front windshield instead of your rear view mirror. You need to get comfortable with your financials.

I want you to have two specific line items every month that will appear on your P&L. These can be automated direct deposits. One should be a deposit into your investment/savings account. The other should be a deposit into your tax payment account. The tax payment account deposit should be approximately $6,000 per quarter. That’s $2,000 per month, so you’ll have a $2,000 transfer from your business operating account into your tax savings account every month.

You want to forcibly keep your business operating account low. With inflation as high as it is right now (at the time of making this video), any money you are not investing is going down in value at a very high rate.

As a rule of thumb, always keep 2-3 months of emergency cash in your business operating account. That’s a 2-3 month cushion. Look at your expenses each month and see how much it costs to keep yourself afloat. Multiply this either twice or three times to keep a cushion in case you have a slow month or if an emergency occurs. Once you get this emergency pad of money in your business operating account, you can then set up the other two accounts and begin building those up.

This Sample P&L Statement is free today for subscribers. I will go over more details on how to use your P&L Statement, as well as context for some of my notes on this sample. So, consider this a “sneak peek!”

If you need more training on how to use your own P&L Statement, be sure to enroll in our online course, Agent Financials. I’ll walk you through this sample statement, line by line, and help you make sense of how to use your own P&L.