How will a recession affect the housing market in 2022? Get Brian Icenhower’s expert analysis on how an economic recession will impact real estate sales and home prices.

Will a recession affect the housing market? This is the question on everyone’s mind. In today’s video, I talk to you about how to educate yourself, and your clients, on the recession and how it will affect the real estate industry. I’ll also share with you some helpful infographics that will help you understand that data behind my words.

And, today you can download some of these market infographics for FREE by subscribing to our blog.

VIDEO: How Will a Recession Affect the Housing Market in 2022?

Fact: Inflation is happening

Inflation is something we really haven’t had in a while. But, we knew it was coming. Now, we have a lot of making up to do. As a result, costs are going up.

Inflation is what happens when a market or an economy is doing too well.

That’s why the Federal Reserve Board increases interest rates. They are trying to slow the economy down. This is how the Fed can “hit the brakes.”

Things slow down. People invest less. People sell their stocks. They don’t buy as much real estate because mortgage rates shoot up. Everything slows a little bit.

Everyone. Freaks. Out.

Don’t freak out

We have been enjoying an out of control economy. People were making more than they have ever made. Credit scores are higher than they’ve ever been. People have more home equity than ever, and more wealth in general. We are seeing the highest percentage of home ownership and housing affordability than ever before.

All it takes is a slight tap on the brakes and everyone thinks the sky is falling. Welcome to today’s media. It makes a good headline, and it’s definitely great click-bait. Will a recession affect the housing market? Don’t get your answer from today’s “breaking news” story.

Today, I’m going to walk you through the reasons why nobody should be freaking out. You must educate yourself so you understand. That way, you can pass that understanding on to your clients.

Will a recession affect the housing market? Realtors must learn & educate clients

Realtors must educate themselves and become the calming voice.

We are experiencing the normal result of an out of control, awesome economy. Our unemployment rate is 3.24%. That is just unheard of.

The idea that the world is going to end is ridiculous. Is there going to be some sort of correction? Yes. The government is trying to make a correction happen by increasing interest rates. So, let’s not freak out. This is normal. This is expected. Everything is okay.

Will a recession affect the housing market? Let’s learn more about what exactly a recession is. But first, why recessions seem to be so controversial and so politically charged.

The politics of a recession

Recessions are very politically charged. If you turn on one media source, you’ll hear about how it’s the end of the world, and the other party’s fault. If you turn on another media source, you’ll hear blame on the opposite political party.

We can’t place blame on one administration or one party, however, because both political parties have contributed to the spending that caused the situation we are in now.

Avoid getting political about this, especially with your clients.

Spending gets out of control, demand gets out of control, and prices go up. There’s not enough supply. It’s as simple as that. Both political parties have spent, and spent, and spent. Now we have to pay it back a bit.

Chances are, if your political party is not in office right now, your choice of media outlet is saying that the world is ending.

Don’t be negative. Inform your clients.

Recession defined

How do you know when you’re in a recession? Technically, a recession is, “two quarters, consecutively, of declining gross domestic product (GDP).”

Understand that we just came off of the three highest quarters in GDP in our country’s history. That is very, very hard to follow. It’s going to be hard to not have two consecutive quarters of declining GDP after those three incredible quarters. It’s like you’re going from an A+ to an A- and you’re saying the sky is falling.

So yes — we are in a recession. Even though we may have the second best business environment in history, we still have to call it a recession because it’s not as great as the very best.

Our media takes these facts and pumps up the drama.

Even pre-Covid, in the years 2011-2019, the economy was doing great. Realtors enjoyed steady appreciation and it was a great time to be in business.

This recession we are headed toward is likely to be even better still than those pre-Covid years. It is not a recession like the one we faced in 2008. We have different circumstances.

Take everything with a grain of salt. A recession does not mean it’s the end of the world.

Infographics to help you answer the question, “Will a recession affect the housing market?”

Now, I am going to go through some of our best market infographics. Our ICC coaching clients have access to all of these graphics (and more) through our coaching program. (If you’re interested in learning more about that, click here.) You can also subscribe to our blog at the bottom of this blog and gain access to several of these high-powered infographics.

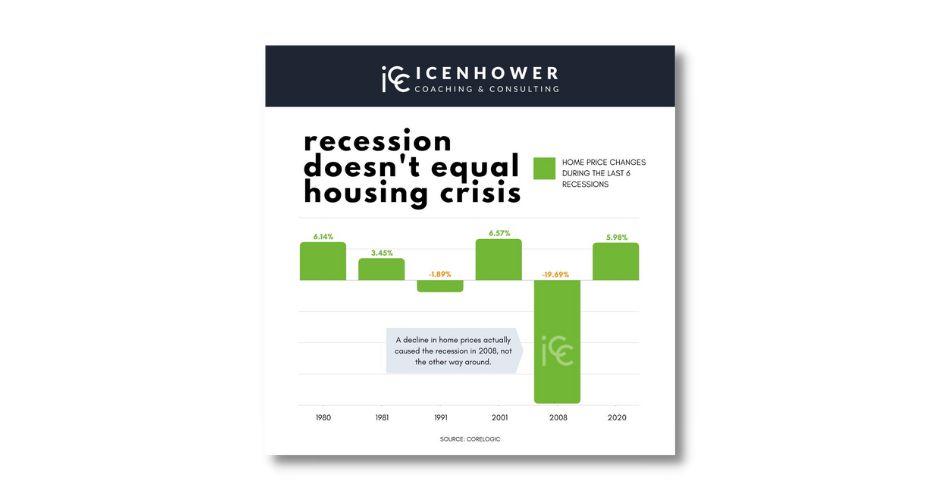

A recession does not equal a housing crisis

Check out this infographic. This helps answer the question, “Will a recession affect the housing market?” We’ve had plenty of recessions that we can look to for clues on what to expect for this recession.

During the recession in 1980, which is a similar recession to the one we are going through right now, the home prices continued to rise at a good rate. High inflation, high interest rates, etc. Interest rates went up to 17% — so we are not seeing anything like that this time around. The economy was super healthy in the 1980s, too.

In 1991 we had a slight recession, a slight dip in rates. Housing prices dropped for about a year.

In 2001, 9/11 created a big recession. That’s how interest rates got down and prices went up. After 9/11 occurred, our economic market shut down.

2008 was the only time we saw housing prices drop; but understand that this situation was different. A decline in home prices actually caused this recession — not the other way around. We had too much housing supply, so home prices dropped. There was not enough real buyer demand. A recession followed. Loans went into default, foreclosures happened, banks shut down — it was terrible.

In 2020, we had a recession, too, from the Covid-19 pandemic. It was so bad, the government started to print money. Everyone was sheltering in place for months. Housing prices went up about 6% over those same months, and about 16% over the whole year. In 2021, housing prices went up another 20%, despite this recession.

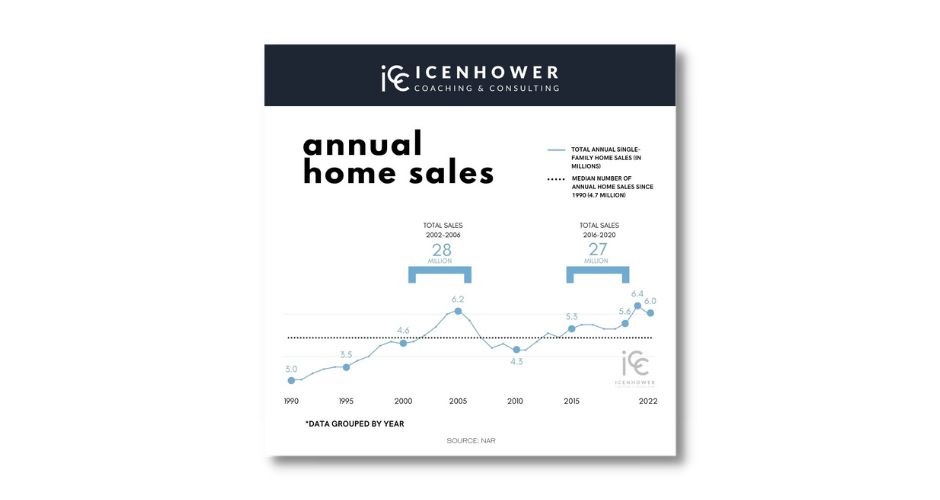

Annual home sales

Here’s another great infographic to look at. Home sales will likely go down during this recession. Why? Slightly less demand. More people staying put. Fewer people listing their homes for sale and fewer people looking to buy.

Last year, we had a record with 6.4 million home sales in the United States. This year, we are projecting 6 million, which would make it the third highest year for homes sales. So yes, it will be down if you look at the numbers year over year.

The media will blast headlines: “Home sales are down! The real estate market is cooling! The bubble is bursting!” But if you read between the lines, which I always encourage, you’ll see that it’s just a mild adjustment that leaves us with a housing market that is still pretty awesome.

Boy, look at 2013 all the way through 2020. We are still higher than those numbers, and those were pretty good years.

We are going from an A+ housing market to an A-.

Yes, we are likely to see less home sales this year. But not that much less. Still, better than almost any other year in our nation’s history.

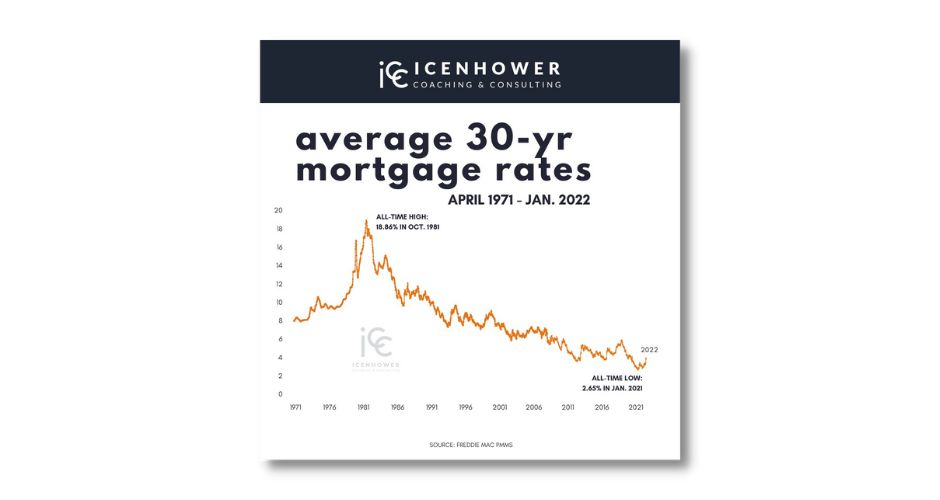

Average 30-year mortgage rates

Yes, this has gone up slightly. But look at the big picture. For those of us who have been doing real estate for several decades, we aren’t worried about a 5% interest rate.

You can see that even in the 1980s, when we had out of control inflation, the Fed started raising the rates to slow down our GDP. It worked. Inflation started to come down. They slowed the economy down through increased interest rates. Nevertheless, home prices continued a steady climb. Nothing affected the home prices.

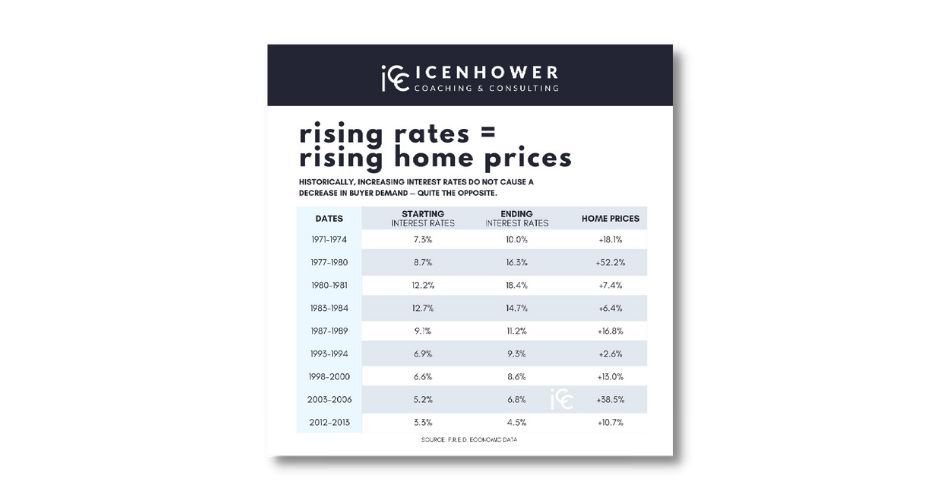

Rising rates = rising home prices

You can see all the different instances where we had a rate increase and a home price increase. In fact, if you go back to 1970, you can see there hasn’t been a single time that we’ve had rates go up where home price didn’t follow and go up at the same time. Not one single time.

Other awesome infographics to answer the question, “Will a recession affect the housing market?”

- Annual appreciation home prices. We are still projecting that home prices will appreciate 16% this year.

- Timeline of housing supply. This timeline is cyclical. Yet, we can see with each cycle, we go lower and lower.

- Why is housing inventory so low? All of a sudden in the 1990s, we started building a lot. We had a record number of homes built. Then, for 14 straight years, we built almost no houses.

- U.S. housing starts. You can see where the housing starts tanked by looking at this graph. And, we’ve been playing catch up ever since.

- Homes built vs population growth. Our population is growing at a rate that our home building can’t keep up with. The more behind we get, the harder it is to catch up with supply.

- Cost of lumber then vs now. This is one of the reasons why it is hard to catch up with supply.

- Volume of loans in billions. Take a look at buyer demand for a minute. Look how many loans we had leading up to the Great Recession for people with a credit score lower than 620. Now look at how many we are doing for low, sub-prime mortgages.

- Household mortgage debt service in the U.S. You can see from this graph that household mortgage debt as a percentage of disposable income is down.

- Mortgage originations by credit score. Look at all the people with credit scores over 760.

- Total U.S. homeowner equity. This is a big reason why this recession is so different from past recessions. U.S. homeowners have more equity in their home than ever before.

- Rent continues to skyrocket. Investors continue to buy up properties and rent them out, despite increased home prices.

Will a recession affect home prices? No. Will it affect home sales? A little.

Hopefully through reading this article and watching my video, you’ll be able to understand the difference. Will a recession affect home prices? No. History shows that appreciation will continue to be steady. However, it will have an affect on home sales. And as I mentioned before, we are talking about a small decrease. We’re going from an A+ to an A- here, nothing drastic.

Supply and demand

Prices are controlled by supply and demand. Rising interest rates does not affect supply and demand because both will decrease at an equal level. Fewer people will list their homes, and fewer people will be looking to buy. As a result, it will remain at the same level. So, supply will still be much lower than demand, causing prices to continue to increase.

Will a recession affect the housing market? Key takeaways

- Keep yourself educated

- Understand that home prices will continue to go up

- Understand that home sales will go down, slightly

- Make sure your clients understand the difference between home prices and home sales

- Keep investing in real estate yourself

Did you know that 74% of Americans can afford to buy a house as of two years ago? Now it’s down to like 66% percent because of the housing prices going up. Back in the 1980s, it was at 42%. That is where we are headed. Homeownership is an American dream. The key word is “dream” because not everyone can achieve it.

Housing prices will not come down any time this decade

It is your job to inform your clients. Many of your clients are not businesspeople. They don’t understand the economy, nor is it their job to do so. It is your job to inform them and educate them on how the economy works and what to expect.

You need to make sure your clients understand that housing prices will not come down anytime soon.

FREE DOWNLOAD: Market Infographics Package

Download several of our market infographics for FREE by subscribing to our blog, below.

Want to learn more?

- Read The High-Performing Real Estate Team. You can buy Brian Icenhower’s best-selling book on Amazon.

- Subscribe to The Real Estate Trainer Podcast. You can find it on Apple Podcasts, Google Podcasts, Spotify, Podbean, and anywhere you listen to your favorite podcasts.

- Join the Real Estate Agent Round Table. We are always posting fresh content — everything from market updates to free templates — and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a subscription sign-up form. You’ll be the first to find out about our new resources, free downloads, premium online courses, and the latest promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.