Managing Money for Real Estate Agents - Use these 4 tips for Realtors to effectively manage their finances to create wealth from their businesses.

This blog will teach you 4 top tips for managing money for real estate agents.

Welcome to our comprehensive guide on “Managing Money for Real Estate Agents”. In this article, we’ll explore the essential strategies and practices for real estate agents to effectively manage their finances. This topic is crucial, especially considering the unique financial challenges faced by agents in their line of work. Let’s dive into the four key areas that are pivotal for financial success.

Be sure to listen to this episode of The Brian Icenhower Podcast and subscribe to the podcast so you never miss an episode!

VIDEO: Managing Money for Real Estate Agents – The 4 Keys

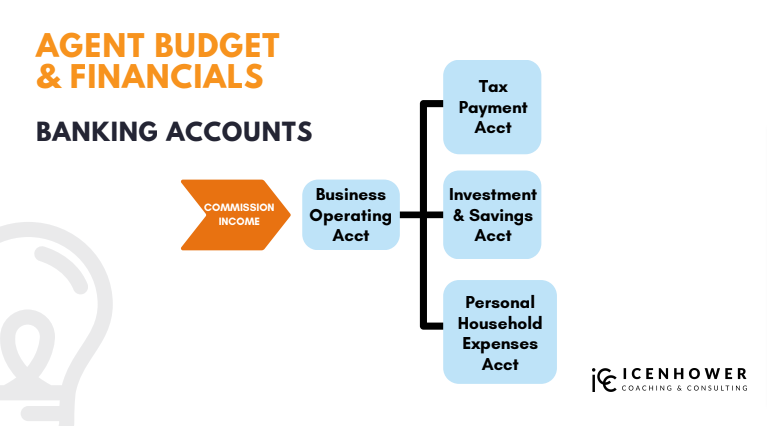

1. Establishing a Structured Banking System

A structured banking system is the foundation of financial management for real estate agents. This system involves setting up four separate bank accounts, each serving a unique purpose:

Business Operating Account

This account serves as the primary hub for all business-related income and expenses. It’s essential for maintaining a clear separation between your professional and personal finances.

Tax Payment Account

Dedicated to handling taxes, this account should be funded monthly in advance. By doing this, real estate agents can better manage their tax liabilities and avoid year-end surprises.

Investment Savings Account

This is where agents save for future investments, such as rental properties or stock market opportunities. Regular contributions to this account are vital for long-term wealth accumulation.

Personal Household Expenses Account

This account is for managing personal expenses that are non-deductible for business purposes. Keeping personal spending separate helps in maintaining a lean budget and focusing on wealth-building.

By using these four accounts strategically, real estate agents can streamline their finances, prepare for tax obligations, invest wisely, and keep personal spending in check.

2. Prioritizing Wealth Management Over Vanity Metrics

It’s common in the real estate industry to focus on sales volumes and awards, but these vanity metrics do not always correlate with financial success. Effective money management for real estate agents involves prioritizing net income growth and wealth accumulation over mere production numbers. By doing so, agents can ensure they are not just earning more but also retaining and growing their wealth.

-

Quick View

Agent Financials

$99Online CourseLearn the best practices that all Realtors should implement to effectively manage their financial systems.

Designed for all learning types

Video Training

In-depth professional video training on every module, presented by the author, Brian Icenhower.Written Modules

Detailed and downloadable written modules with detailed graphics, scripts, spreadsheets, forms, and so much more.Audiobook

Since real estate agents are always on the move, your training must be too. This course provides a professional downloadable audiobook.Course curriculum

Enrollment includes access to the following course materials for 2 years

Module 1: Managing Agent Financials- VIDEO: Managing Agent Financials

- AUDIO: Managing Agent Financials

- Workbook: Managing Agent Financials

- Agent Financials Banking Accounts

- VIDEO: Mastering the Realtor Budget

- AUDIO: Mastering the Realtor Budget

- Workbook: Mastering the Realtor Budget

- Real Estate Budget Schedule (example)

- Real Estate Budget Schedule (fillable)

- VIDEO: Grasping the Profit & Loss Statement

- AUDIO: Grasping the Profit & Loss Statement

- Workbook: Grasping the Profit & Loss Statement

- Sample Profit & Loss Statement

- VIDEO: Analyzing Business Financials

- AUDIO: Analyzing Business Financials

- Workbook: Analyzing Business Financials

About this course

- $99.00

- 15 lessons

- 1.5 hours of video content

Immediate Takeaways

Here is what you can expect to gain from taking this online course.

- Learn best accounting practices for your real estate business, and what to look for in an accountant.

- Understand the purpose of the Real Estate Budget Schedule and how you can use it to determine the levels of spending necessary to keep your business growing.

- Learn why you need to look at your Profit & Loss Statement quarterly, and how to use it to see exactly where you're at.

- Once you are able to access your P&L Statement, you will learn what each line item means and how to use it to determine where you fall on the Real Estate Budget Schedule

- Get insight into how you can use your P&L Statement and your Real Estate Budget Schedule to now make the changes needed by diagnosing your own issues and prescribing your own next steps.

- Become empowered and take charge of your financials so that you never feel in the dark again when it comes to your income, your spending, and the growth of your real estate business.

Reviews

"I use ICC systems, the Online Learning Center, and the coaching program to coach and train my team of over 30 agents. I use the ICC dashboard systems to keep my entire team accountable for their activities and set proper expectations."Jake Rockwell Over 500 Units Sold Annually "I have coached with ICC for over five years. ICC has helped me quadruple my luxury business through marketing strategies so that I receive listings and sales through lead generation and multiple pillars of income."

Dennis Adelpour Luxury Agent - West Los Angeles "When we started coaching with ICC we worked all the time with some degree of success. Now, seven years later, we have grown to have the #1 market share in our area, we more than tripled our income and production, while also improving our work-life balance to enjoy our personal life with family and friends."

Tammi Humphrey #1 Market Share & 100 Million in Annual Sales Volume I use ICC systems, the Online Learning Center, and the coaching program to coach and train my team of over 30 agents. I use the ICC dashboard systems to keep my entire team accountable for their activities and set proper expectations.

Jake Rockwell

Over 500 Units Sold Annually I have coached with ICC for over five years. ICC has helped me quadruple my luxury business through marketing strategies so that I receive listings and sales through lead generation and multiple pillars of income.Dennis Adelpour

Luxury Agent - West Los Angeles When we started coaching with ICC we worked all the time with some degree of success. Now, seven years later, we have grown to have the #1 market share in our area, we more than tripled our income and production, while also improving our work-life balance to enjoy our personal life with family and friends.Tammi Humphrey

#1 Market Share & 100 Million in Annual Sales Volume Instructor Brian Icenhower.I created Agent Financials because there is simply no other training out their like this specifically for real estate agents.

Most agents have no idea where they are at financially. You are not an "average agent", though, and you are tired of living your life (and running your business) by looking through the rear view mirror. It's time to learn how your P&L Statement and budget can be used to start looking through the windshield as you navigate your way through the process of growing your business. Now is the time to step up your game. This is a high-level course that has been boiled down to the essentials. I'll explain everything from start to finish, and by the end, you'll feel much more comfortable with your financials, and you can immediately begin to put what you learn into action. You will learn the necessary changes that you need to make to get on track to grow the real estate business of your dreams."My business is growing, but for some reason, I'm broke."

We hear this all the time. When real estate agents don't truly understand their financials, they always feel in the dark about their numbers. It's time to take control. Empower yourself to understand your financials so you can start making decisions today that will impact your business's future success. Add to CartAgent Financials

More about this real estate training course

Talk to a coach

If you've been considering hiring a coach, now's the time. Book a FREE coaching consultation session with your purchase of this course! Book Your CallSee all courses

-

Quick View

1×1 Solo Agent Weekly Coaching Program

$1,000 / monthThis 1×1 Solo Agent Weekly Real Estate Coaching Program designed to help you increase your production and your commission income with strategies and systems for sustainable business growth.

3. Proactive Tax Planning and Management

Proactive tax planning is a critical aspect of managing money for real estate agents. Instead of waiting until the end of the year, agents should work with a full-service accountant to make estimated tax payments throughout the year. This approach allows agents to adjust their tax strategies in real time, based on their current financial performance, thereby maximizing their opportunities to reduce tax liabilities.

4. Balancing Business Growth with Personal Time

Achieving a balance between increasing income and having personal time is essential. The goal is to not only grow your business but also to have time for family, hobbies, and personal interests. This balance is crucial for long-term success and personal well-being.

A well-planned budget is crucial for eliminating the common financial ups and downs in real estate.

Brian Icenhower

Conclusion: Managing Money for Real Estate Agents

Managing money effectively is a critical skill for real estate agents. By establishing a structured banking system, focusing on wealth management, engaging in proactive tax planning, and balancing business growth with personal time, agents can secure their financial future. This approach not only aids in building wealth but also ensures a fulfilling career in real estate.

Remember, it’s not just about working harder but working smarter. By implementing these four keys, real estate agents can pave the way for financial stability and success in their professional and personal lives.

Jake Rockwell

Over 500 Units Sold Annually

"I have coached with ICC for over five years. ICC has helped me quadruple my luxury business through marketing strategies so that I receive listings and sales through lead generation and multiple pillars of income."

Jake Rockwell

Over 500 Units Sold Annually

"I have coached with ICC for over five years. ICC has helped me quadruple my luxury business through marketing strategies so that I receive listings and sales through lead generation and multiple pillars of income."

Dennis Adelpour

Luxury Agent - West Los Angeles

"When we started coaching with ICC we worked all the time with some degree of success. Now, seven years later, we have grown to have the #1 market share in our area, we more than tripled our income and production, while also improving our work-life balance to enjoy our personal life with family and friends."

Dennis Adelpour

Luxury Agent - West Los Angeles

"When we started coaching with ICC we worked all the time with some degree of success. Now, seven years later, we have grown to have the #1 market share in our area, we more than tripled our income and production, while also improving our work-life balance to enjoy our personal life with family and friends."

Tammi Humphrey

#1 Market Share & 100 Million in Annual Sales Volume

I use ICC systems, the Online Learning Center, and the coaching program to coach and train my team of over 30 agents. I use the ICC dashboard systems to keep my entire team accountable for their activities and set proper expectations.

Tammi Humphrey

#1 Market Share & 100 Million in Annual Sales Volume

I use ICC systems, the Online Learning Center, and the coaching program to coach and train my team of over 30 agents. I use the ICC dashboard systems to keep my entire team accountable for their activities and set proper expectations.