With mortgage rates reportedly on the rise, it is more important than ever to inform clients about how low mortgage rates still are compared to past years. Home buyers that decide to wait for rates to drop a mere quarter of a percent run the dangerous risk of seeing rates adjust back up to the historical averages and pricing themselves right out of the market. Also, home buyers and sellers often focus too heavily on home prices with very little thought about mortgage rates. They only concern themselves on the price they pay for a home, or the price that they are able to sell their home for. Mortgage rates become just an afterthought. Yet now more than ever rising mortgage interest rates should be more of a concern than rising home prices. After all, home sellers that wait a year for values to rise to get an extra $5,000 to $10,000 for their home may find themselves turning around to buy their next home with mortgage rates 1% to 2% higher by then. This would amount to paying an extra $50,000 to $100,000 over the life of a normal 30 year amortized loan. Which is precisely why the time to buy or sell a home is now.

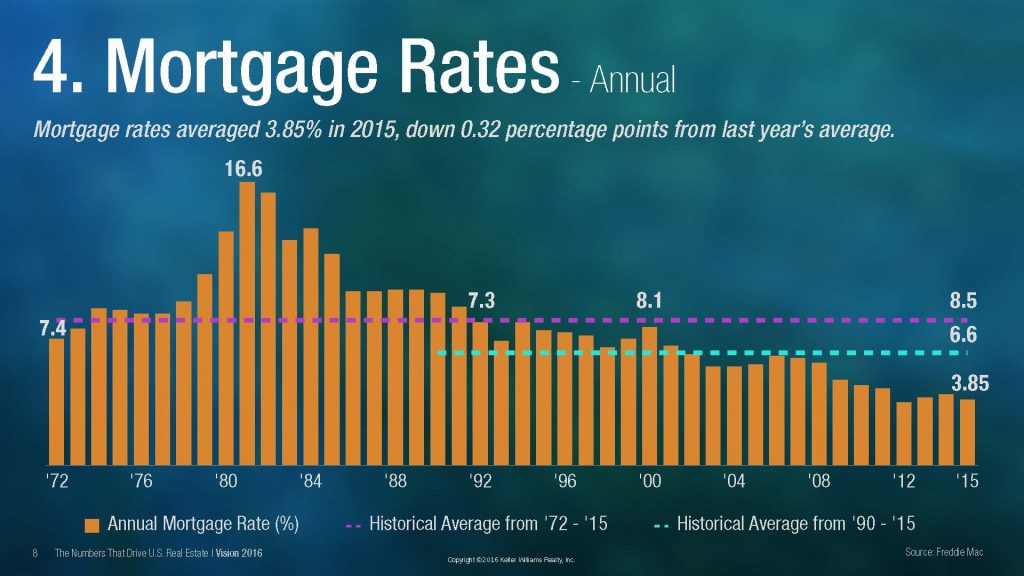

Annual Mortgage Rates

The infographic provided courtesy of Keller Williams Realty International below illustrates that for more than 40 years the average mortgage rate has been 8.5% according to data provided by Freddie Mac. With average mortgage rates slowly trending up over the last 3 years, it is reasonable to assume that waiting to buy or sell poses a significant financial risk.

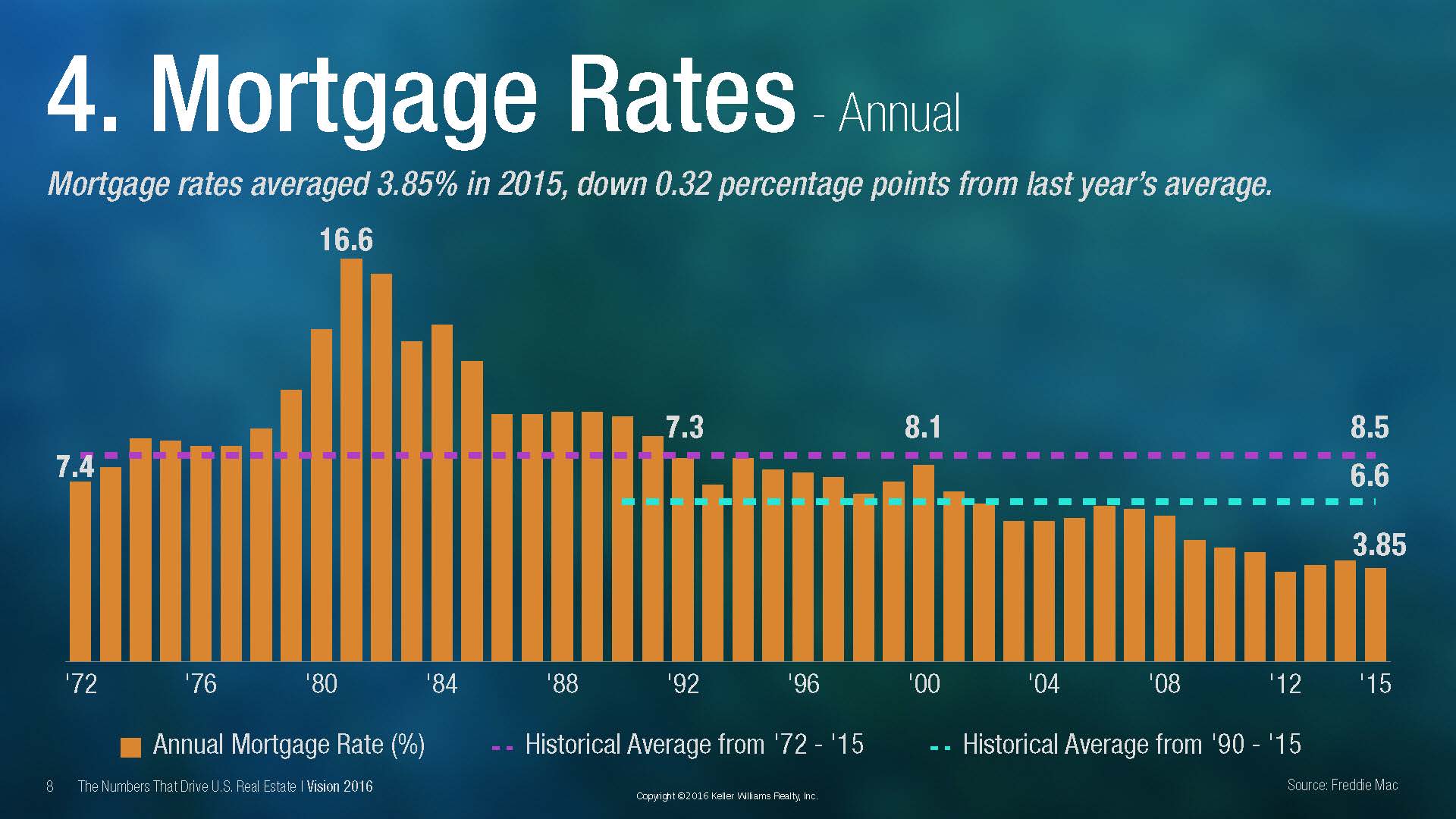

Mortgage Rates put Housing Affordability in Perspective

The graphic created by Keller Williams Realty International below shows that after adjustments for inflation are made, the cost of owning a home was significantly higher 20 years ago due to today’s low mortgage rates.

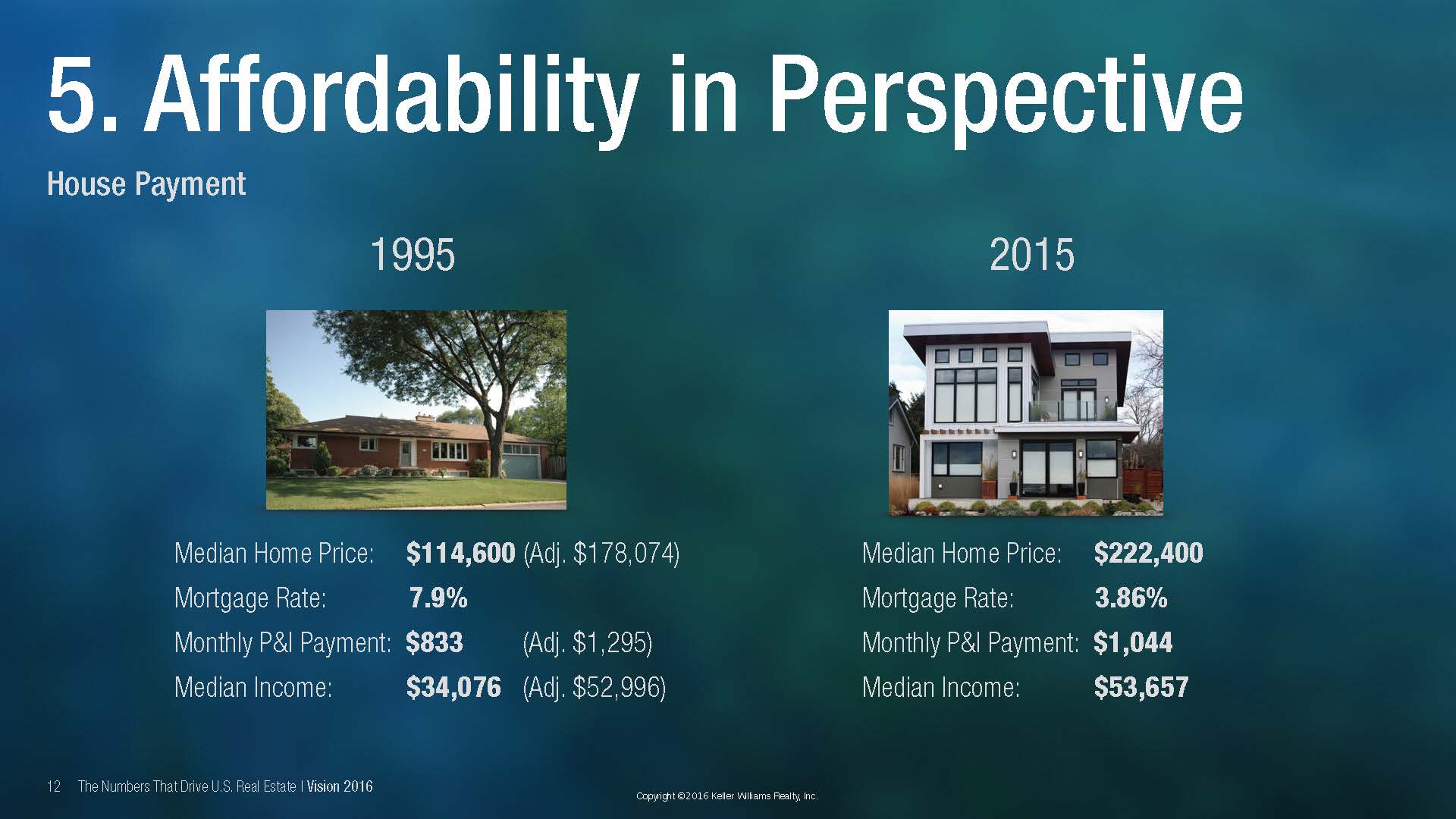

Mortgage Rate Projections

This Keeping Current Matters infographic shows how housing industry leaders Fannie Mae, Freddie Mac, the Mortgage Bankers Association and the National Association of REALTORS® all predict that mortgage rates will steadily increase over the course of the year.

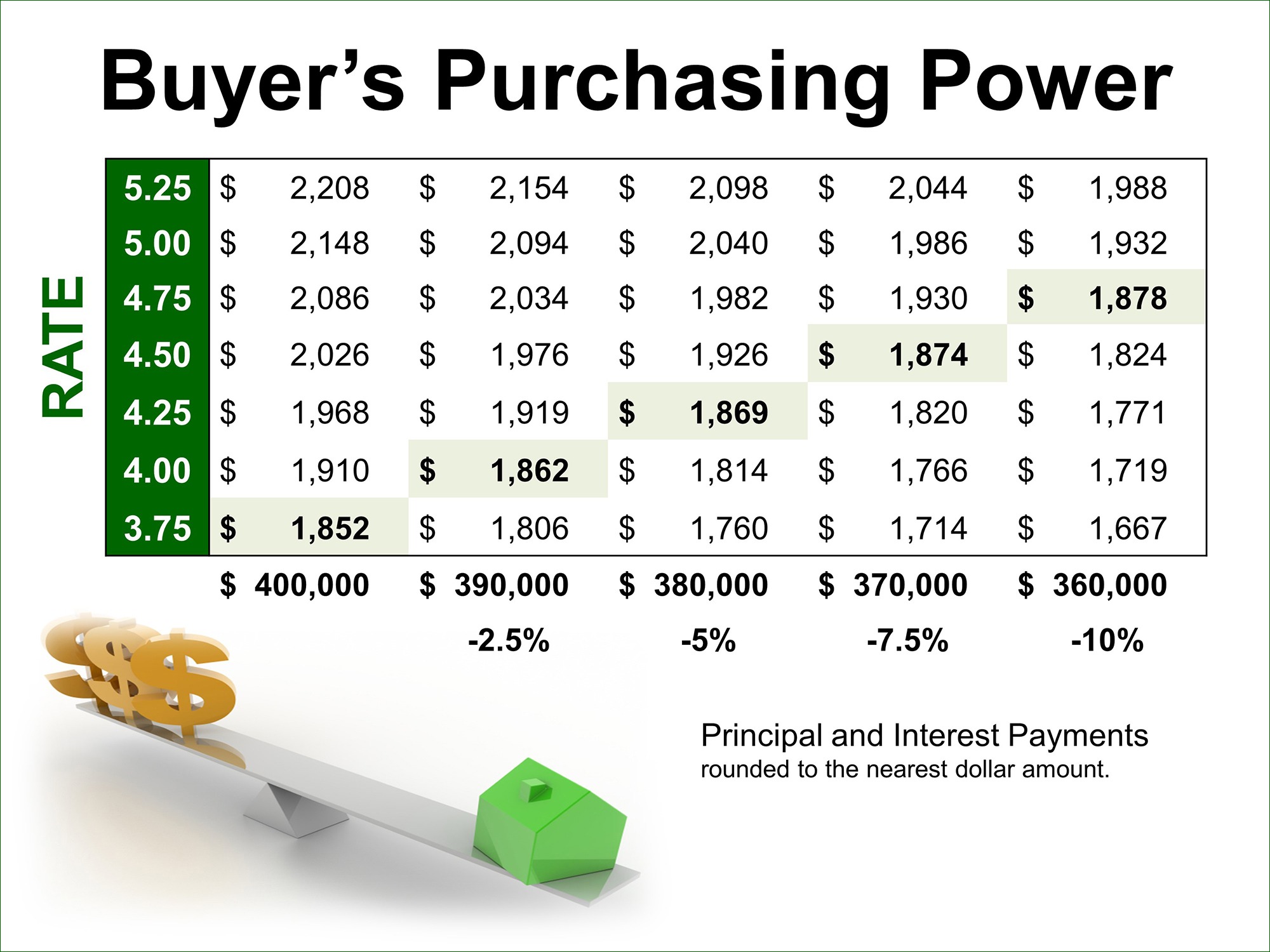

How Mortgage Rates Impact Buyer Purchase Power

As shown in the Keeping Current Matters graphic below, rising mortgage rates also have a negative impact on home sellers by diminishing the purchasing power of prospective buyers by effectively pricing them out of the market with increased monthly payments. Home sellers that wait to sell will also likely face higher monthly payments when they buy a replacement home.

For more scripts, dialogues and talking points to overcome objections by prospective client waiting to buy or sell a home, please visit our real estate agent scripts library.

Pre-Listing Package Contents & Strategies

Real Estate Transaction Coordinator Job Description

Listing Presentation Scripts & Dialogues

Top 10 Real Estate Farming Ideas

Lead Follow Up Scripts & Methods

Open House Guest Lists – Scripts to Get Them Filled Out

Ways to Grow a Real Estate COI Quickly

Inside Sales Agents on Real Estate Teams

REALTOR Database Contact Plans & Scripts

Realtor Vendor Databases: Scripts & Lists to Build Them

The One Page Real Estate Business Plan

How to Transfer Facebook Friends to your Client Database

A Real Estate Administrative Assistant’s Job Description

FSBO Prospecting Scripts & Objection Handlers

Open House Scripts to Generate New Listings

Scripts for Buyers: How to Show Less Homes

Just Listed & Just Sold Real Estate Scripts

What to Say When Calling FSBO Sellers for Listings

Managing & Compensating Buyer’s Agents on Real Estate Teams

Easy Ways to Ask Your Clients for Referrals

Scripts for Overcoming Listing Presentation Objections

When Should I Start a Real Estate Team?