Profit and Loss Statement for Realtors – Learn the various itemized components of a real estate agent’s P&L statement, and the most important line items to pay attention to.

Today we are going to talk about a profit and loss statement for Realtors. I’m going to share with you our Sample P&L Statement and show you how to go through your own, line by line, and understand the important parts and how to use them as you get a handle on your agent financials.

And, if you want a more detailed, step-by-step training when it comes to your P&L, budget, and all-things financial, enroll in our online course, Agent Financials. This is next level stuff!

VIDEO: Understanding a Profit and Loss Statement for Realtors

Time to get real

So far, in our mission to get a grip on agent financials, we’ve discussed how a real estate agent should manage their financials. We’ve also covered how to create a real estate budget, what that budget should look like, and how to use the budget and analyze it to move forward.

All of this is great in theory. But how do we look at what is actually going on in your business?

Remember, the budget schedule applies to all agents – solo agents and teams alike. Everything is calculated in percentages, so it applies to agents with any production level.

Now that you have this information, you can apply it to your individual Profit & Loss Statement (P&L). Time to get real, folks!

Your profit and loss statement for Realtors

Your profit and loss (P&L) statement for Realtors is the most vital document to understand the back end of your business.

Most agents concentrate on offense. They are much more interested in learning how to fine-tune their lead generation than understanding their P&L. This is the dirty work.

Your P&L statement is the most vital document to understand the back end of your business.

Successful business people know that it’s not about units closed. It’s not about income earned. It’s about profit. This happens after expenses. Are you making money? This is where the P&L comes in.

Is your production high, yet you are broke?

At ICC, we coach some of the most high-producing teams in the country. We get clients with teams selling 2,000+ homes per year. You’d be shocked at how many people will come to us and say, “We closed 1,500 homes this year. But, we’re broke.” They aren’t making any money.

So, we introduce them to this concept of a P&L. We show them how to chart their expenses. Until you look at a P&L, you really don’t know if you are making money or not. All you can do is check your bank to see how much money is there at the end of the month. This is not a great way to run a business.

The P&L helps you look at the big picture.

Agents tend to get very emotional with expenses based on how much income they are producing. It is important to keep yourself out of your emotions and focused on the numbers. You need to operate like a business person.

Sample Profit and Loss Statement for Realtors

At the end of this blog, we provide you with a FREE download of a sample P&L Statement. I’m going to go over the fundamentals so you can download this file and understand how to use (and understand) your own P&L Statement.

Look at your P&L statement at least twice a year. You could also do it quarterly or monthly.

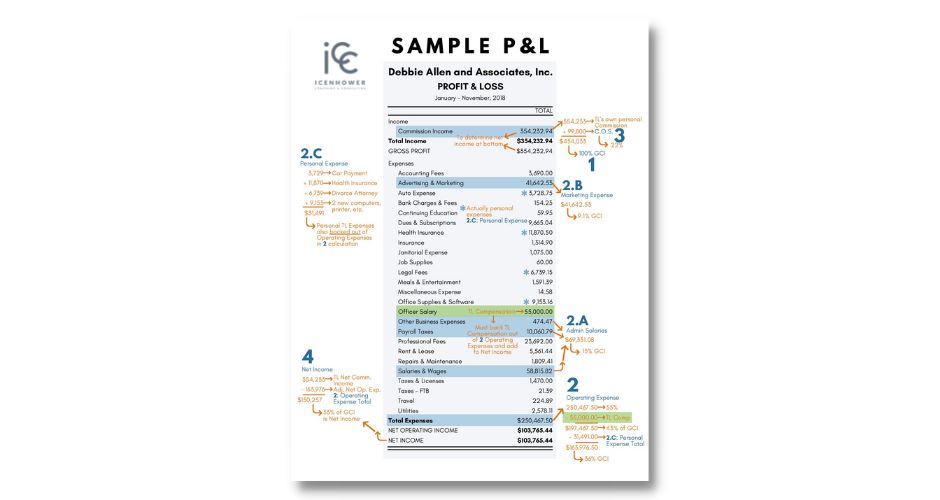

Now, let’s look at the Sample P&L and identify the sections you need to understand.

Understanding your profit and loss statement for Realtors

At the top, we have Income. Your income is going to be commission income. You might have a couple different types of commission income, depending on who your accountant is.

#1: Your GCI

First, look at #1 – you are going to try to determine what your GCI is. This is also your Gross Profit. This is before you take out all of your expenses. This number is your 100% – the “whole” that all the other percentages will come together to make up.

Remember, this is also the number at the top of your budget that you take all of your other percentages from. GCI is what you have before you take out your Cost of Sales, or pay out any splits.

Note: A lot of people screw up here. They put their Net Commission Income in this spot. Your Net Commission Income is what you get after you pay your split.

#3: Your Cost of Sales

Once you figure out your #1 – your GCI – in the meantime, you’ve also figured out your #3 – your Cost of Sales. This is the amount that you pay out in splits. You need to know your Cost of Sales in order to calculate your true GCI. So, now you know both!

#2: Your Operating Expenses

Now, you jump down to work on your Operating Expenses, which is #2. Most of the line items on your P&L are expenses. Near the bottom of your P&L, you’ll see the total for your expenses.

The problem is – this number is never accurate. Not even close. So you need to do some adjustments. Your accountant creates this P&L with the tax liability mindset in that they want to reduce the amount you owe in taxes.

So, you need to back out many of the numbers listed as expenses here because they do not apply to your budget needs.

#2a and #2b: Your Admin Salaries, Marketing, and Lead Generation Expenses

First, look at #2a. These are your administrative salaries. Then, look at #2b. These are your marketing and lead generation expenses. Remember, your Operating Expenses should be 30% of your #1 (GCI). More than two-thirds of your Operating Expenses come from #2a and #2b.

So, on the profit and loss statement for Realtors, this is where you will do the most work. It’s easy work, though I’m betting you didn’t think you’d be doing this as a real estate agent. However, it’s this that sets you apart from the typical, low-producing agent. This is the stuff that takes you to the next level.

It’s this that sets you apart from the typical, low-producing agent. This is the stuff that takes you to the next level.

To calculate your Operating Expenses, you need to figure out your #2a and your #2b.

You will also notice that #2c includes all of your personal expenses. After you subtract your #2c and your “Officer Salary” from your total Operating Expenses, you will have a more accurate number.

Percentages on your profit and loss statement for Realtors

Why do you keep calculating percentages? So you can use them to reference the Real Estate Budget Schedule to see if you are on track. For instance, with the example we are using and our Sample P&L, you can see that the #2a is a little high. It is at 15%, and your target should be closer to 12% for your administrative salaries.

#4: Net Income

Finally, you take the Net Commission Income as listed at the top and subtract your Operating Expenses (#2) to get your Net Income. In this Sample P&L, we see that this number comes to 33% of GCI. To me, that is a little low.

When your profit and loss statement numbers are off-target

This happens all the time, and is a testament to why it is such a great idea to have a coach. A coach can help you diagnose what is off-kilter. In this Sample P&L, for example, the expenses are high and the income is low. There is no clear fix that can be found by simply looking at the numbers alone.

Having the knowledge that expenses are high and income is low will help you avoid making mistakes. For example, if you were thinking of hiring, you would know that now is not a good time.

FREE DOWNLOAD: Sample P&L Statement

This Sample P&L Statement is free today for subscribers. This is the same document that I went over, in detail, within the video in this blog. Highlighted in the PDF, you’ll see my notes on what is important to pay attention to, and which numbers to use when calculating your Net Income. And, how to see if you’re on track when comparing it to the Real Estate Budget Schedule.

If you need more training on how to use your own P&L Statement, be sure to enroll in our online course, Agent Financials.

Want to learn more?

- Read The High-Performing Real Estate Team. You can buy Brian Icenhower’s best-selling book on Amazon.

- Subscribe to The Real Estate Trainer Podcast. You can find it on Apple Podcasts, Google Podcasts, Spotify, Podbean, and anywhere you listen to your favorite podcasts.

- Join the Real Estate Agent Round Table. We are always posting fresh content — everything from market updates to free templates — and host dynamic discussions with the industry’s top producers.

- Subscribe to our newsletter. In the sidebar of this blog, you’ll see a subscription sign-up form. You’ll be the first to find out about our new resources, free downloads, premium online courses, and the latest promotions.

- Reach out and talk to an ICC coach. Not sure which of our coaching programs is right for you? Let us help you.